The COVID-19 pandemic has put economies around the globe under one of the most severe stress tests, and Japan is not immune.

Since the onset of the COVID-19, the Japanese authorities have been supporting corporates and households suffering from its knock-on effects. The economic and social policies have been unprecedented over the past three months.

The Bank of Japan attempted to stabilize the market by buying more risky assets in March and has abolished the annual limit of Japanese government bond purchases in April. In May, it introduced a new lending program to support small and medium-sized enterprises.

The government announced an unprecedented series of economic stimulus packages equivalent to about 40 percent of GDP, partially financed by two supplementary budgets, in the first two months of its fiscal year. To contain the virus, a six-week-long nationwide state of emergency was implemented from mid-April. Today, restarting the economy on a full scale remains challenging, given the sporadic outbreaks in Tokyo and other prefectures.

Fast-changing domestic and external environments

The domestic and external environments have been fast-changing amidst this health crisis, which has significantly affected the trajectory of the Japanese economy and the structure of its balance of payments with the rest of the world.

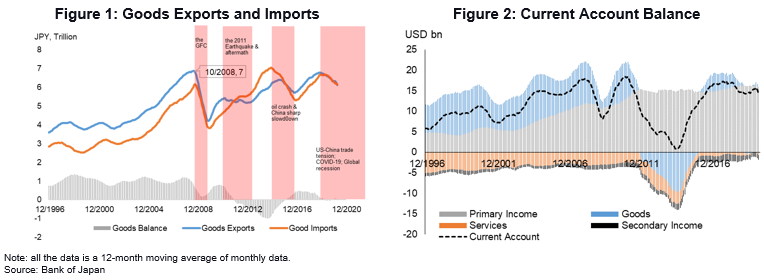

Before the pandemic, Japan’s current account balance—including goods, services, and income flows—was in substantial surplus mainly due to sustained primary income inflows, and a narrowing service deficit. From late 2018, its net goods balance was around zero when global growth eased further amidst the US-China trade tensions.

In retrospect, Japan’s traditional goods trade surplus turned into a deficit during the Global Financial Crisis (GFC). This was followed by the Great East Japan Earthquake in 2011 that disrupted the supply chain for exports and expanded fuel imports to replace nuclear energy.

The enlarged trade deficit was contained due to the crash in global oil prices in the second half of 2014, and the trade balance turned into surplus with the strong rebound of China demand in 2017 (Figure 1). However, as indicated in the longer-term trend, Japan’s goods trade surplus has vanished in recent years, along with a declining share in some high-tech goods exports.

Drivers of Japan’s external balance

Driven by royalties from the Intellectual Property Rights received from overseas and growing receipts from tourist arrivals, Japan’s service account deficit has been narrowing, contributing positively to the overall current account surplus since 2013. Its tourism sector has benefited from a weaker currency and supportive government policies.

The strong overseas investments by Japanese businesses and residents over the past decades led to the expansion of Japan’s primary account surplus over time (Figure 2). This is the primary driver of the current account surplus in Japan, reflected in rising direct investment earnings and significant portfolio investment incomes.

The continued recycling of its sizable current account surplus to outward investments has allowed Japan to remain the world’s largest investor in terms of net investment assets and investment incomes. In 2018, Japan’s net investment assets reached USD3.1 trillion (62 percent of GDP), ahead of Germany (USD2.4 trillion), and China (excluding Hong Kong) (USD2.1 trillion). Its USD189.1 billion investment income was also ahead of other countries except for the United States.

In the short run, a China-US rivalry beyond trade, the COVID-19 economic fallout, and strict border controls are factors that could drive Japan’s external balance. As a result, Japan could see a narrowing current account surplus and continued financial outflows.

While Japan’s goods trade will continue the current downward trend, the balance is unlikely to turn negative as the correlation between exports and imports strengthens from a decade ago due to global value chain integration. The recovery of tourism-related service will also be bumpy.

The primary income account, which largely determines the size of the current account surplus, could adjust with a time lag. During the GFC, the surplus declined by 27 percent in JPY terms, and by around 12 percent in USD terms (Figure 3).

The primary income account, which largely determines the size of the current account surplus, could adjust with a time lag. During the GFC, the surplus declined by 27 percent in JPY terms, and by around 12 percent in USD terms (Figure 3).

The dampened outflow of outward direct investment has been offset by more overseas investment of domestic investors seeking higher returns since early 2020 (Figure 4). While outward direct investment will stay soft due to an uncertain global outlook driven by the pandemic and geopolitical risks, the outward portfolio investment could be more active going forward.

The longer-term prospect of Japan’s overall external balance will depend on how its foreign investments evolve in a new world, defined by the outcome of the COVID-19 pandemic and possible reconfiguration of the global supply chain. Meanwhile, amid the aging population, Japan’s domestic savings may decline in the long run, which could shrink the resources available for foreign investment.

To conclude, while Japan’s external position is likely to remain strong, there is room for government policies to play active roles in adapting to structural changes.

Taking the COVID-19 situation as a catalyst, the government should further promote digitalization, develop healthcare technologies and advanced manufacturing, enhance tourism service and attract more inward FDI to improve the external balance and shape the new growth strategy. Externally, policy efforts toward maintaining a benign global environment upholding trade multilateralism would always be essential for the Japanese economy.