For years, Lao PDR has actively encouraged both domestic and foreign investment to strengthen its economy. Leveraging its central position along key North–South and East–West corridors in mainland Southeast Asia, the country has sought to attract manufacturing and logistics investors through Special Economic Zones (SEZ), with a view to integrating into regional value chains and developing export-oriented industries.

Building a land-linked regional hub

While Lao PDR trails peers like Thailand and Vietnam in infrastructure quality, labor skills, and market sophistication, it offers distinct advantages, including a strategic position along regional economic corridors, competitive operating costs, and abundant natural resources.

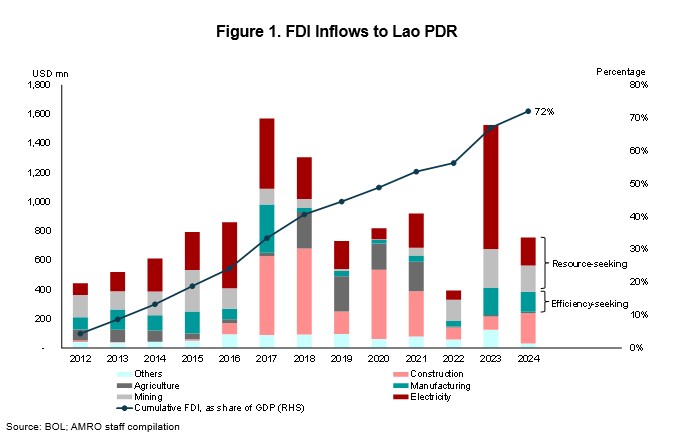

Foreign direct investment (FDI) has remained steady over the past decade. Although resource-seeking FDI in mining and hydropower still accounts for a substantial share, investment has gradually diversified toward efficiency-seeking activities, particularly in manufacturing and agriculture (Figure 1).

This shift has been reinforced by Lao PDR’s transformation to a “land-linked” economy with the completion of the Lao PDR-China Railway in 2021. Estimates by the World Bank (2020) suggest the railway could reduce domestic transport costs by 20-40 percent and cross-border costs between Kunming and Vientiane by 40-50 percent. Travel time from Vientiane to Boten has dropped from approximately 15 hours by road to just 4 hours by rail, spurring investment in logistic parks, agro-processing facilities, and regional distribution hubs along the corridors.

In addition, Lao PDR’s competitive operational costs have strengthened its attractiveness. Electricity tariffs remain lower than those of many regional peers, while the Investment Promotion Law provides flexible land-lease arrangements and fee exemptions within SEZs.

Key revisions to the latest regulatory framework

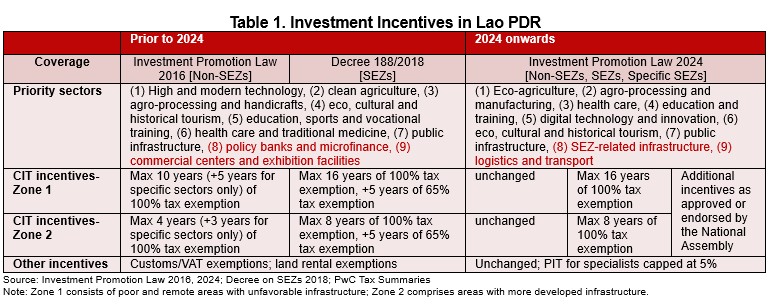

Lao PDR’s investment framework is anchored in the Investment Promotion Law, first enacted in 2009 and amended in 2016 and 2024. The law provides a range of incentives, most notably tax benefits, to domestic and foreign investors, differentiated by sector and infrastructure conditions at investment locations. SEZs receive preferential treatment, including higher incentives, streamlined administrative procedures, and improved infrastructure.

The 2024 amendment realigns priority sectors with national development and sustainable growth goals. Key additions include SEZ-related infrastructure, logistics, and warehousing, reflecting the country’s enhanced regional connectivity.

The amended law also unifies the various SEZ incentives schemes into a single legal framework while retaining existing corporate tax holidays. In addition, the personal income tax rate for specialists in promoted sectors is now capped at a low 5 percent (Table 1).

Reforms beyond tax incentives and labor market

While the latest regulatory framework has provided fresh impetus, several gaps remain. The 2024 Investment Promotion Law permits the government to grant additional incentives to specific SEZs, subject to National Assembly approval. Intended to attract targeted investment, this discretion may allow investors to negotiate extra tax benefits, heightening the risks of policy uncertainty, unequal treatment, and weakened transparency. Since standard SEZ incentives already exceed those offered by neighboring countries, discretionary add-ons for selected zones also risk becoming overly generous and could further erode Lao PDR’s narrow tax base.

Moreover, the effectiveness of these income-based tax incentives is increasingly constrained by global tax reforms. Under Pillar Two of the OECD/G20 global minimum tax initiative, large multinationals must pay a minimum effective tax rate of 15 percent. When Lao PDR grants tax holidays or exemptions below that rate, the investor’s home jurisdiction can reclaim the benefit through “top-up” taxes.

Labor market bottlenecks also hinder the investment environment. Many FDI companies hire few local workers due to skill gaps. A significant share of Lao workers lack the technical training required in key industries, while many others migrate abroad for higher wages. Employers also face high staff turnover and inconsistent attendance. To maximize the employment impact of FDI, Lao PDR will need to improve local workforce reliability and competitiveness through vocational training and skills upgrades.

These domestic challenges are further compounded by shifting global trade dynamics amid US tariff policy uncertainty. To sustain FDI inflows, Lao PDR should target investors seeking diversified regional markets while strengthening its non-tax advantages. Priority actions include accelerating infrastructure upgrades, particularly by addressing last-mile connectivity between industrial sites and rail hubs, improving cross-border customs procedures, and simplifying investment approval processes at both central and local levels.