The Philippines has once again claimed the global spotlight. At the prestigious World Travel Awards (WTA) Asia and Oceania Gala held in October 2025, the country swept six major titles—including Asia’s Leading Beach Destination, Leading Dive Destination, and Leading Island Destination. Boracay and Clark Freeport Zone earned individual honors, while the Department of Tourism was named Asia’s Leading Tourist Board.

These accolades reaffirm the Philippines’ standing as one of Asia’s premier destinations. But beneath this string of successes lies a deeper question: How can the country convert global recognition of its natural beauty into a powerful engine for sustainable and inclusive growth—one that benefits communities across the archipelago?

An economic pillar yet to fully recover

Tourism has long been a cornerstone of the Philippine economy. In 2024, the sector’s gross value added reached ₱3.5 trillion—7 percent higher above pre-pandemic levels—and accounted for 13.2 percent of GDP. It also supported 4.9 million jobs, or 13.8 percent of the labor force. AMRO’s analysis shows that tourism-related industries—such as hotels and restaurants—can generate higher domestic value-added per unit of production input than the average for all sectors, making the sector a key driver of the country’s post-pandemic recovery.

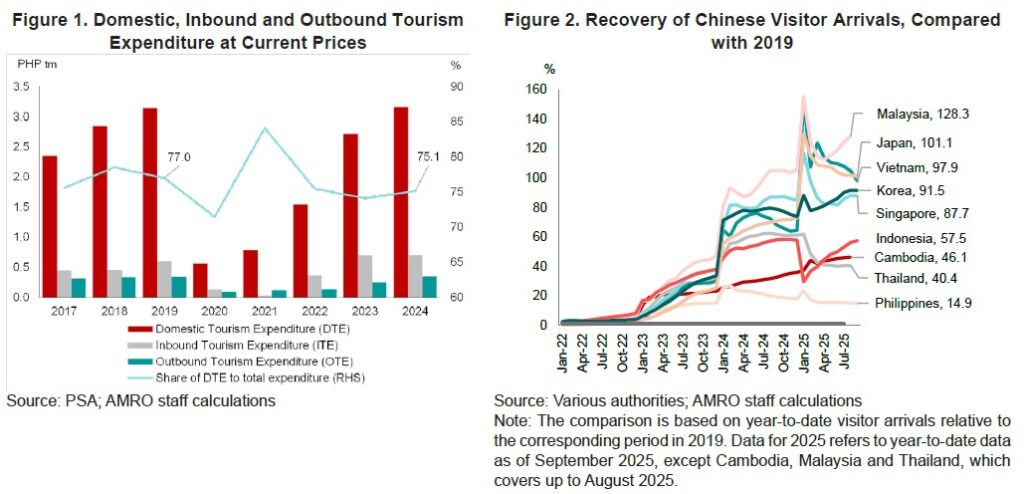

Yet the picture is uneven. While domestic tourism continues to anchor overall demand, the rebound in international visitors has been slower than expected. In 2024, domestic tourism expenditure rose to ₱3.2 trillion, marginally higher than in 2019 and accounting for three-fourths of total tourism spending (Figure 1).

Foreign arrivals, however, totalled only 5.9 million in 2024, still about 28 percent below pre-pandemic levels. A major drag has been the sluggish return of Chinese tourists. Arrivals from China stood at just 312,342—only 17.9 percent of the 2019 level—shrinking their share of total international arrivals from 21.1 percent in 2019 to 5.3 percent. Among ASEAN peers, the Philippines has experienced the weakest recovery in Chinese arrivals (Figure 2).

Encouragingly, inbound tourism receipts tell a more positive story. Revenues surged to ₱760.5 billion, 26.7 percent higher than in 2019, suggesting that those who visit are spending more and staying longer—reflecting stronger traveler confidence and improving service offerings.

Policy directions: Bridging physical and soft infrastructure gaps

Unlocking the next phase of the Philippines’ tourism growth requires addressing long-standing infrastructure gaps that limit accessibility, competitiveness, and visitor experience.

Compared with ASEAN peers, the Philippines’ international tourism market remains relatively small. Even before the pandemic, the country lagged regional peers in foreign arrivals—8.2 million foreign visitors—well below Indonesia’s 16 million, Malaysia’s 26 million, Thailand’s 40 million, and Singapore’s 15 million. Moreover, foreign tourists remain concentrated in a few destinations: the National Capital Region and Central Visayas (home to Cebu) account for over 60 percent of total foreign overnight stays. Many promising sites remain underdeveloped or difficult to reach.

A strategic, long-term expansion and diversification of the tourism footprint must address bottlenecks in:

- Transport connectivity: Investments in airports, seaports, and road networks are essential to improving access across islands, increasing visitor flows, and dispersing tourism benefits more evenly.

- Basic utilities and sustainability infrastructure: Reliable utilities—water, sanitation, electricity, and waste management systems—are critical for sustaining service quality and strengthening visitor experience, especially for island and eco-tourism destinations where carrying capacity is a concern.

- Digital readiness and visitor facilities: Complementary investments in broadband connectivity, digital booking and payment systems, and well-designed facilities such as visitor centers and convention halls can elevate comfort, safety, and service quality for visitors.

Meanwhile, soft infrastructure—human capital, service standards, and institutional capacity—remains equally vital. Government initiatives such as the Philippine Experience Program and Filipino Brand for Service Excellence seek to upgrade service quality, rehabilitate various destinations, diversify product offerings, and emphasize Filipino hospitality.

The recent resumption of the e-Visa program for Chinese nationals is another important step in revitalizing inbound markets. Going forward, expanding training programs for hospitality workers and local enterprises, strengthening inter-agency coordination, and sustaining reforms in zoning, environmental management, and safety standards will be key. These efforts, anchored in the National Tourism Development Plan 2023–2028, can help forge a more harmonized and efficient tourism ecosystem.