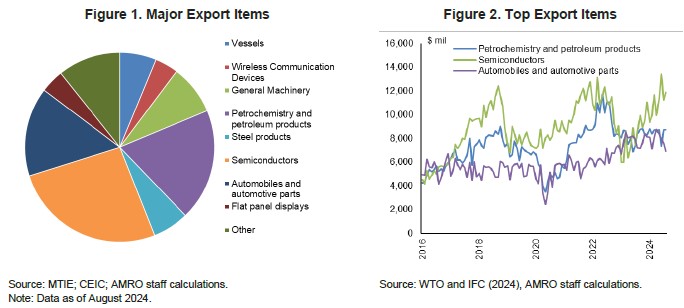

The automobile industry accounts for a considerable share of Korea’s exports. As of August 2024, automobiles and automotive parts accounted for approximately 15 percent of the country’s total exports, ranking third after semiconductors and petrochemical products (Figure 1). While the sector continues to demonstrate robust performance—particularly through rising passenger car exports—it now faces a rapidly evolving global landscape that poses significant challenges over the near to medium term.

A resilient export engine

Korea’s automotive sector is a stabilizing force within its broader export framework. In recent years, Korea’s automobile exports have displayed steady and consistent growth compared to the more cyclical performance of other major export sectors (Figure 2).

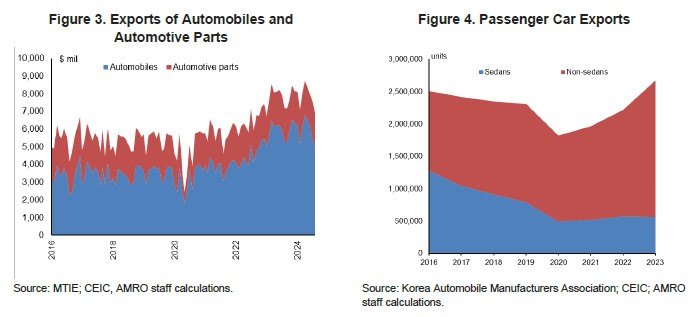

A notable driver of this growth has been the export of fully assembled vehicles—particularly passenger cars. Since 2020, exports of fully assembled automobiles have increased significantly, while those of automotive parts have remained relatively flat (Figure 3). This divergence is in part due to the growing demand for fully assembled vehicles, particularly hybrids and SUVs, as well as the challenges faced by Korea’s parts producers in transitioning to more eco-friendly technologies. By 2023, passenger cars represented an impressive 97 percent of the Korean automobile industry’s exports.

The rise of non-sedans and eco-friendly vehicles

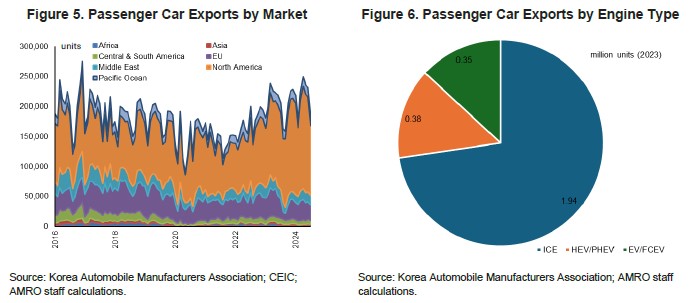

During the mid-2010s, export volumes of sedans and non-sedans—such as SUVs and multi-purpose vehicles (MPVs)—were relatively balanced (Figure 4). However, demand for non-sedans has since surged, particularly in the US and Canada, accounting for around two thirds of Korea’s total passenger car exports (Figure 5).

As environmentally friendly passenger vehicles—which include hybrid electric vehicles (HEVs), plug-in hybrids (PHEVs), electric vehicles (EVs), and hydrogen fuel cell electric vehicles (FCEVs)— have become more popular, Korea’s exports of these vehicles increased by over 30 percent year-on-year. While this growth is noteworthy, internal combustion engine (ICE) vehicles still dominated most of Korea’s automobile exports. Of the 2.67 million passenger cars exported in 2023, less than 30 percent were eco-friendly models (Figure 6).

Key challenges on the horizon

Despite having formidable industrial capabilities, Korea’s automobile export outlook faces several challenges. The recent heightening of US protectionist trade policies poses a severe blow to Korea’s automobile industry. The imposition of a 25 percent tariff on imported automobiles and certain automobile parts will threaten Korea’s ability to be price competitive vis-a-vis US automakers, given that the US accounts for roughly half of Korea’s automobile exports.

In the EV market, Korean automakers face intense international competition. Chinese manufacturers are rapidly expanding their foothold in the US and Europe, key markets where Korea’s presence remains relatively modest. Compounding the challenging outlook are vulnerabilities within the supply chain. Korea is heavily reliant on imports of essential minerals—such as lithium, cobalt, and nickel and any export restrictions on these critical inputs could significantly inflate production costs and hinder Korea’s efforts to scale up EV manufacturing.

Further complicating Korea’s EV ambitions is the so-called “EV Chasm”—a transitional phase in the product adoption cycle marked by slow uptake beyond early adopters. Key barriers to mass-market acceptance include inadequate charging infrastructure, excessive charging time, and consumer anxiety over driving range. Domestically, recent high-profile incidents involving battery fires have eroded public trust in the safety of EVs, potentially hindering domestic adoption and the development of a resilient home market that can support broader export expansion in the future.

Comprehensive support package and the way forward

As far as EVs are concerned, despite the challenges outlined above, Korea has the technological know-how and industrial capacity to adapt and thrive—if strategic actions are taken. Korean automakers can leverage their strengths in design and engineering to distinguish themselves in an increasingly crowded global EV market. Also vital is securing a more diversified and stable supply of critical minerals through international partnerships. To encourage greater EV adoption domestically, boosting investment in battery safety and charging infrastructure is crucial.

To boost the automobile industry, the government rolled out a comprehensive support package in April 2025. The package includes low-cost financing worth 15 trillion won to prevent liquidity issues among automakers; a 1-trillion-won fund—financed by automakers, financial institutions, and credit guarantee funds—to help parts makers secure guarantee for bond issuance; a reduction in the special consumption tax on new car purchases to stimulate domestic demand; an increase in the EV purchase subsidy to support EV manufacturing; tax deferral for companies affected by the US tariff; and export vouchers and trade insurance assistance for exports to “Global South” markets.

More measures can be deployed to shore up exports and boost the industry’s profitability. For exports to the US market, pricing strategies should be well-calibrated to ensure competitiveness, taking into consideration the varying levels of tariffs faced by other major car-producing countries, while safeguarding profitability. Meanwhile, expanding the footprint from non-US markets to emerging economies are crucial through existing trade agreements, negotiations on trade agreements with countries where the automobile markets are underserved, and continued government financial support.

Lastly, continued investment in production facilities in the US, as well as other countries with a large consumer base, with a view to satisfying local demand will become increasingly vital. Such investments can help bolster Korea’s national income less through export earnings but rather repatriated profits.