Amid rising climate change concerns, the ASEAN+3 region has been scaling up its green finance efforts. While the benefits of green finance to environmental and economic sustainability are well-recognized, their implications for financial stability remain little-known.

As of early 2024, ASEAN+3 accounts for around 20 percent of global green bond issuance, reflecting the regional push for sustainability. Borrowing through green bonds seems cheaper than conventional bonds due to the green premium, or greenium, but it is important to quantify the magnitude and assess if that is justified.

AMRO’s analysis shows that green bonds in ASEAN+3 offer an average greenium of 15 basis points in the primary market. Furthermore, a larger greenium is observed in green bonds that are certified by a trustworthy party or denominated in local currency.

This lower borrowing cost is particularly beneficial for financing green projects, as they typically require a large amount of investments with longer maturities. In the current environment of relatively high interest rates and increasing debt levels, this green premium can potentially mitigate financial stability risks by easing the burden on borrowers, thereby reducing the likelihood of defaults and help maintain financial stability.

However, not all findings are positive. Greenwashing—misleading claims about the environmental benefits of a product or investment—can pose significant financial stability risks by eroding investor confidence; triggering fund withdrawals that may lead to sharp asset price corrections and market instability.

Evidence from the green building sector indicates that firms issuing green bonds for such projects even increase their carbon emissions, raising concerns for regulators about potential greenwashing.

Although the immediate financial stability risks are likely minimal as the portion of green bonds is still small in the total bond market, these risks could escalate if firms exploit increasing investor interests by issuing more green bonds without proper verification or monitoring of fund usage.

Another financial stability risk from the rapid shift to green finance may arise from stranded assets—assets that may lose economic value due to climate-change-related impacts (environmental, regulatory, or market changes)—in the transition to a greener economy. These assets pose risks to banks, particularly those heavily exposed to carbon-intensive sectors, as they can weaken loan portfolios, heighten the likelihood of credit defaults, and diminish asset values.

Stranded assets could lower banks’ capital adequacy ratios by 1.18 percent in Plus-3 economies (China; Hong Kong, China; Japan; and Korea) and 1.53 percent in ASEAN economies. This underscores the need to incorporate the risk of stranded assets into comprehensive risk management frameworks.

Furthermore, climate elements should be incorporated into the banking regulatory framework to prevent vulnerabilities associated with stranded assets from accumulating in banks’ portfolios.

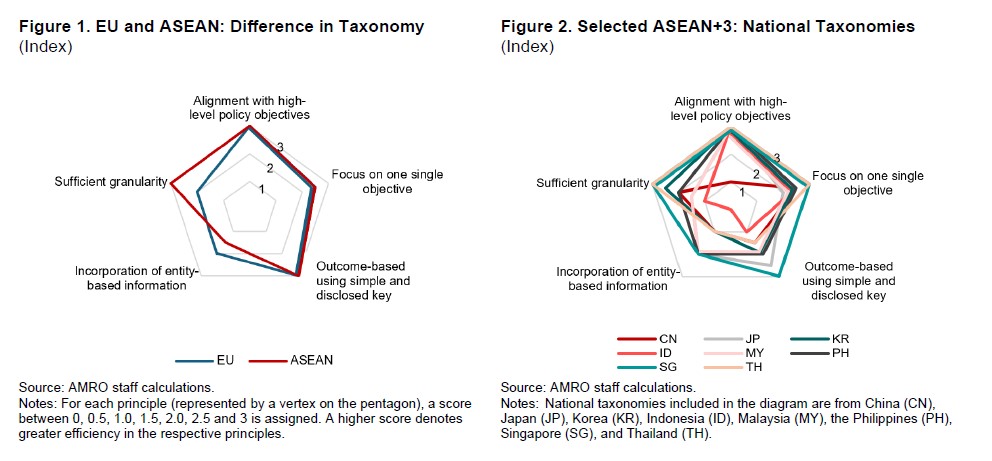

It is also crucial to reduce information asymmetry by enforcing a well-designed green taxonomy to mitigate greenwashing risks. AMRO’s assessment of green taxonomies has found that national taxonomies developed by selected ASEAN+3 economies generally perform well based on the five principles illustrated below. However, there is still room for improvement in the areas of incorporating entity-based information and data disclosure enforcement (Figures 1 and 2).

ASEAN+3 financial regulators recognize the risks of stranded assets from the rapid growth of green lending and have taken key steps to address them on the banking regulation front. These include issuing transition plans and climate risk management guidelines and encouraging banks to incorporate climate risks into stress testing, aligned with the Basel Core Principles for effective banking supervision.

More can be done to fully integrate these principles into current practices, such as explicitly including climate risks in the calculation of risk-weighted assets and reinforcing supervisory expectations.

Green finance is essential for the transition to a more sustainable economy, though we remain far from closing the capital gap. To harness the full potential of green finance, while safeguarding financial stability and promoting sustainable economic growth, policymakers should ensure transparency, robust verification, and regulatory oversight to maintain trust in green finance.