The US dollar holds a disproportionately large share in global cross-border banking, foreign exchange reserves, currency trading, external financing, and as an invoicing currency. For ASEAN+3, over 80 percent of trade invoices are in US dollars, while more than half of banks’ cross-border assets and liabilities are dollar-denominated. Nearly 85 percent of all ASEAN+3 currency trading is against the US dollar, and Asia Pacific central banks allocate 68 percent of their reserves to dollar assets. Although ASEAN+3’s trade and investment exposure to the US has declined over the past decade, the dollar’s dominance in cross-border activities remains intact.

The US dollar’s predominance in ASEAN+3’s external financing far exceeds direct trade, foreign direct investment (FDI), and portfolio investment links to the US. Statistical analysis shows that a currency’s share in external financing is strongly influenced by its historical share, reflecting inertia in currency choice. Export destinations and sources of inward portfolio investment also impact the currency selection for external financing.

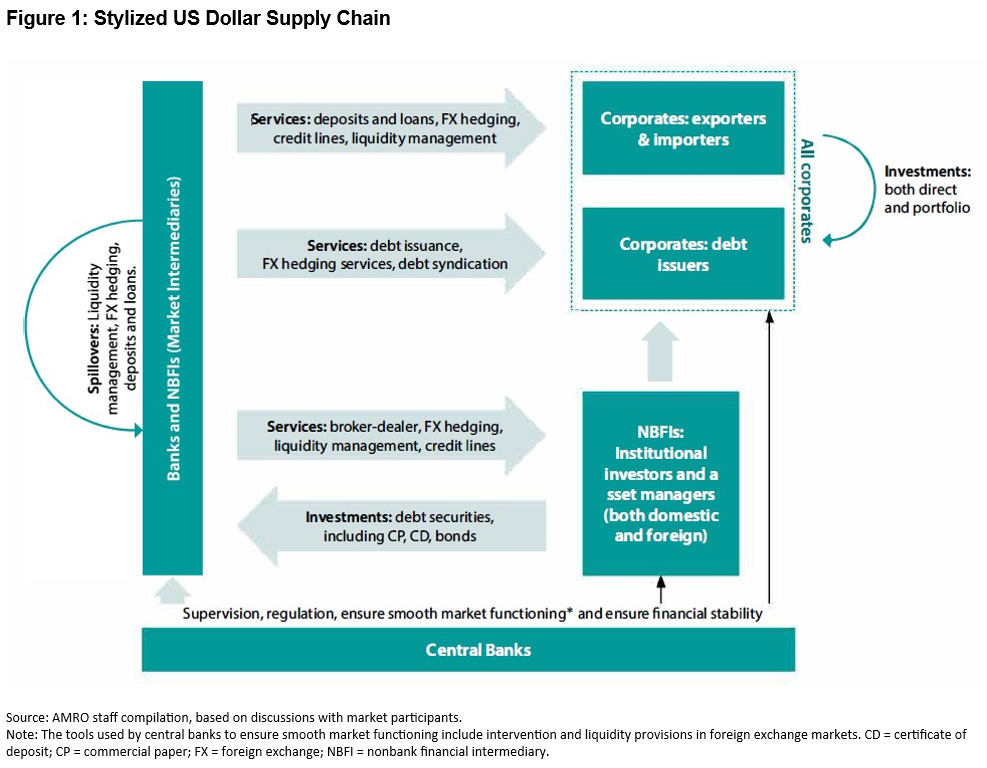

The US dollar supply chain —how the US dollar flows—in the ASEAN+3 financial system is complex, with inflows from exports and USD bond issuances and outflows from imports and USD debt repayments. Nonbank financial intermediaries (NBFIs), such as institutional investors and asset managers, offer currency, maturity, and credit risk transformation services, while banks provide USD loans, deposits, and risk management services, often retaining some currency and maturity risks from client activities. Corporations, NBFIs, and banks are interconnected through transactions and business needs, each playing a role in channelling US dollar flows within the ASEAN+3 financial system (Figure 1). The preferences and practices of these participants, in turn, have a significant impact on exchange rate dynamics and USD liquidity.

Risks to ASEAN+3 financial system

ASEAN+3’s heavy reliance on the US dollar has created two key financial stability risks for the region.

First, the region is exposed to US dollar funding stress, which typically intensifies during high market volatility and currency depreciation expectations. This pressure increases borrowing costs, restricts funding access, and limits foreign exchange hedging services provided by ASEAN+3 financial intermediaries, raising USD liquidity risks for non-financial companies due to reduced hedging and credit line drawdowns.

Second, the US dollar serves as a transmission channel for global shocks, including shifts in US monetary policy, amplifying spillover effects through portfolio rebalancing and exchange rate channels. During global market stress, these shocks are transmitted to ASEAN+3 markets through the US dollar’s status as a safe asset.

The Fed’s rate hikes since 2022, surprisingly, have not triggered US dollar funding stress in ASEAN+3 markets. This resilience is partly due to ASEAN+3’s strong external position and supportive micro-market factors, such as increased USD deposits from domestic investors, reduced USD borrowing, and negative carry costs on leveraged investments.

Furthermore, the US funding landscape has stabilized since the March 2023 regional banking crisis. The end of the Fed’s quantitative tightening, along with potential rate cuts, could further ease USD liquidity conditions.

Policy recommendations

In the short term, ASEAN+3 policymakers should prioritize enhancing resilience to external shocks transmitted through the US dollar by maintaining strong economic fundamentals, which have helped stabilize the region during the 2022-2023 Fed rate hikes.

Policymakers should strengthen the surveillance of US dollar liquidity and cross-border capital flows to support timely policy responses. Robust macroprudential regulations for banks and NBFIs would help mitigate US dollar funding risks.

Equally important, regional cooperation and financing arrangements could offer support to ASEAN+3 economies facing US dollar liquidity pressures during balance of payments crises.

Over the long term, ASEAN+3 economies should reduce their reliance on the US dollar to strengthen resilience. Diversification of currencies helps mitigate risks if a particular currency becomes a source of stress.

Further, increasing the use of local currencies in regional trade and financial transactions, supported by coordinated regulations and technology, could make local currencies more attractive for cross-border transactions. Not only does this reduce spillovers from external forces, regional currencies could also play a meaningful role in the ASEAN+3 financial system.

In conclusion, while the US dollar’s dominance brings certain efficiencies to the ASEAN+3 financial system, it also poses notable risks to the region’s financial stability. To strengthen resilience, ASEAN+3 policymakers should continue to prioritize economic stability, enhance monitoring of USD liquidity and cross-border flows, and implement robust macroprudential measures. Through coordinated regional efforts and strategic diversification, ASEAN+3 economies can enhance their financial resilience and foster a more balanced currency ecosystem.