The ASEAN+3 property market has faced significant challenges post-pandemic, marked by falling property prices and transaction volumes, especially in several Plus-3 economies (China; Hong Kong, China; Japan; and Korea). Tighter financial conditions, excess property inventory, sluggish growth in China, and weakened buyer confidence have worsened the situation. The collapse of China property giants, Evergrande and Country Garden, has exposed vulnerabilities with potential spillover effects on financial institutions.

A snapshot of property developer vulnerabilities

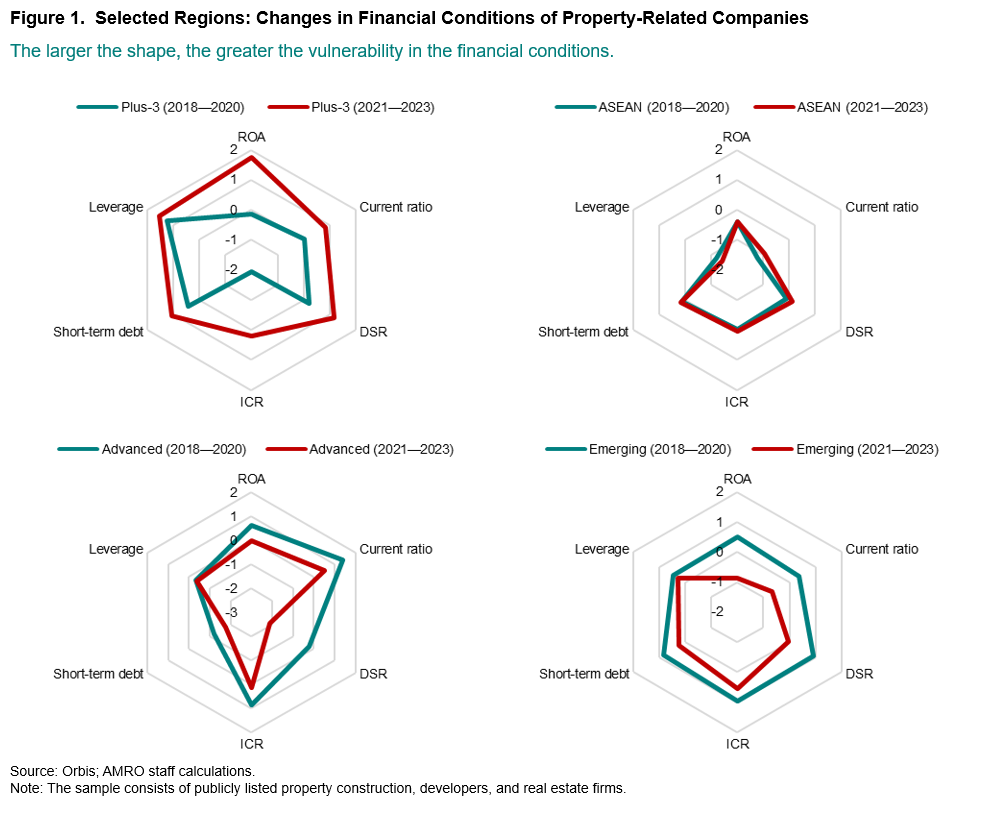

The financial health of property developers in the Plus-3 economies saw a sharp decline between 2021-2023, particularly in profitability and debt-servicing capacity (Figure 1). ASEAN economies were less affected.

Outside ASEAN+3, advanced and emerging market economies have fared relatively better, despite challenges in commercial real estate in the US and in some countries in Europe.

One of the key risks affecting the financial health of property developers is refinancing. Over 20 percent of bonds issued by property developers in ASEAN+3 will mature by 2025—many rated as junk, thereby increasing default risk. High leverage, which was beneficial during boom periods, now amplifies financial risks as interest rates rise and market conditions deteriorate.

Potential spillovers to the financial sector

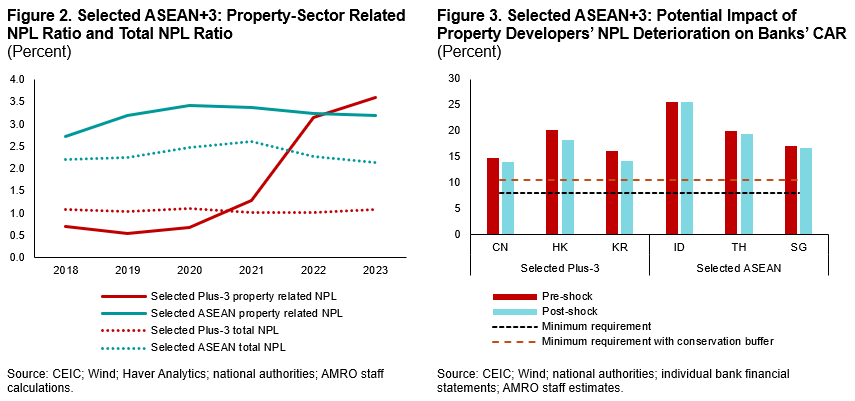

The rise in property-related non-performing loan (NPL) ratios since 2021 has been particularly notable in the Plus-3 economies (Figure 2). Though overall NPL ratios remain stable, there are concerns about banks’ credit risks from exposure to the property sector.

AMRO’s stress test suggests that the banking sector’s robust capital buffers will likely prevent a systemic crisis, despite the risks from the property sector. Even if property-related NPLs rise, banks are expected to maintain sufficient capital, with capital adequacy ratios (CARs) staying well above Basel requirements (Figure 3).

However, smaller banks and shadow banking activities tied to property developers remain vulnerable, particularly in Cambodia, China, Hong Kong, Korea, and Vietnam. These institutions have significant exposure to distressed developers, or real estate project financing.

While isolated failures among small banks may not pose systemic risks, a cluster of failures of these banks or spillovers from shadow banking could trigger broader financial instability.

A dual strategy to mitigate risks

A two-pronged approach is recommended for mitigating risks stemming from property developer financing.

First, implementing property market measures to mitigate the impact of worsening market sentiment is essential to prevent fundamentally sound firms from defaulting and destabilizing the market. They include targeted support for viable projects under temporary liquidity stress.

Additionally, demand stimulation policies—applied cautiously and tailored to each country’s unique circumstances—can alleviate current pressures in the property sector.

Second, enhancing the soundness of the financial sector is important. This includes diversifying the business models of small regional banks, savings banks, and non-bank financial institutions, as well as tightening regulatory oversight and encouraging prudent lending practices to prevent broader market instability.

When adopted concurrently, this dual strategy can help the authorities stabilize both the property and financial sectors, and build resilience for the future.