Soaring public debt has long been a significant concern in Japan. At the end of fiscal year 2022, Japan’s government debt has plateaued at over 260 percent of GDP, warranting a more comprehensive understanding of its fiscal system.

One of the unique yet less-known characteristics of Japan’s fiscal system is the presence of Special Accounts. In 2003, then-Finance Minister, Seijuro Shiokawa was quoted as saying, “While in the main sitting room (i.e., general budget) we’re eating rice porridge to save money, in the separate rooms (i.e., Special Accounts), children are secretly eating sukiyaki.”

Japan’s Special Accounts

Special Accounts play an important role in Japan’s fiscal management, providing a unique framework for earmarked funds separate from the general budget. They are designed to ensure the targeted allocation of resources for specific policy objectives.

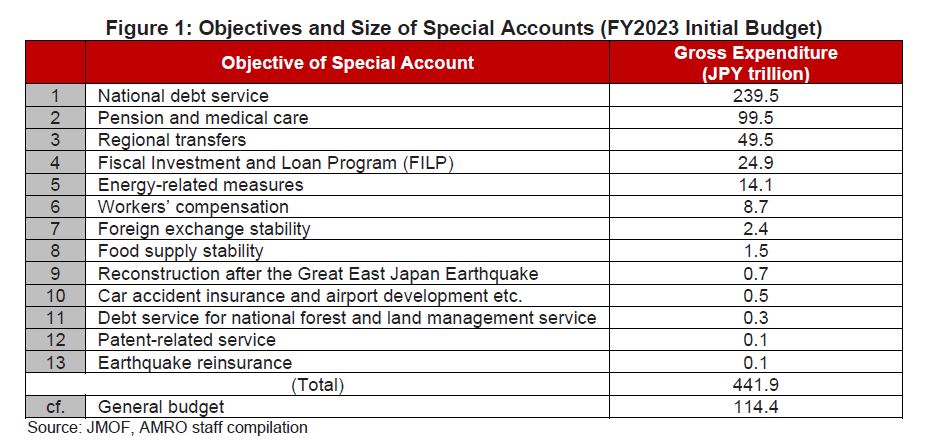

As of FY2023, there were 13 Special Accounts dedicated to specific purposes such as national debt service, pension and medical care, regional transfers, and Fiscal Investment and Loan Program (FILP) (Figure 1).

While some Special Accounts receive transfers from the general budget and other accounts, their financial sources also include earmarked revenues from specific taxes, fees, and other dedicated streams. Certain accounts are authorized to issue Japanese Government Bonds (JGBs) and borrow from banks to meet their expenditure needs.

In the initial budget of FY2023, the total gross expenditure from these 13 Special Accounts amounted to JPY442 trillion, whereas that from the general budget stood at JPY114 trillion (if you eliminate the impact of inter-account transfers included in the gross expenditure, the total expenditure from Special Accounts decreases to JPY197 trillion).

Operations under Special Accounts – FILP

Within the spectrum of Special Account operations, the FILP stands out as unique, characterized by its extensive range of activities, substantial expenditure, and independence from tax revenues.

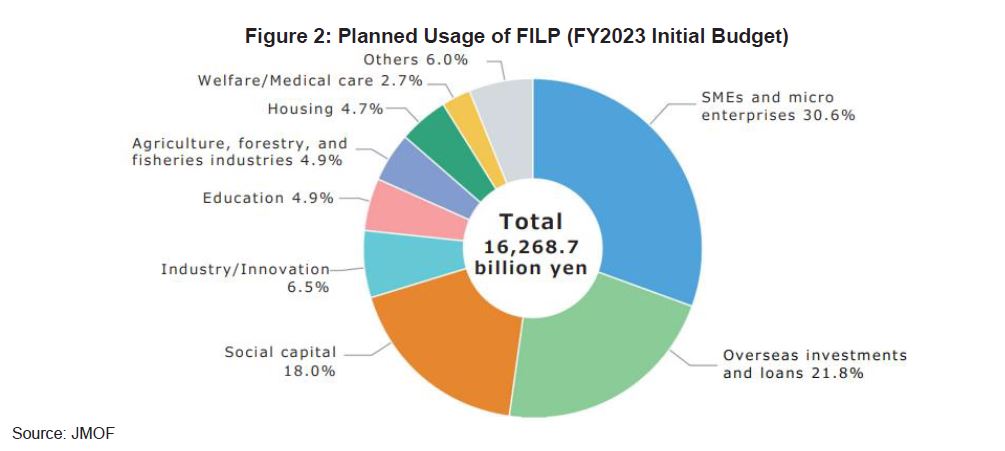

Supplementing the private sector, the FILP plays a pivotal role in providing mid- to long-term financing for projects that contribute to Japan’s economic development and social welfare. These projects encompass infrastructure development, natural resource acquisition, agriculture, forestry and fishery, housing supply, innovation, education, and more (Figure 2). Most recently, the government utilized the FILP to provide financial support to companies affected by the pandemic.

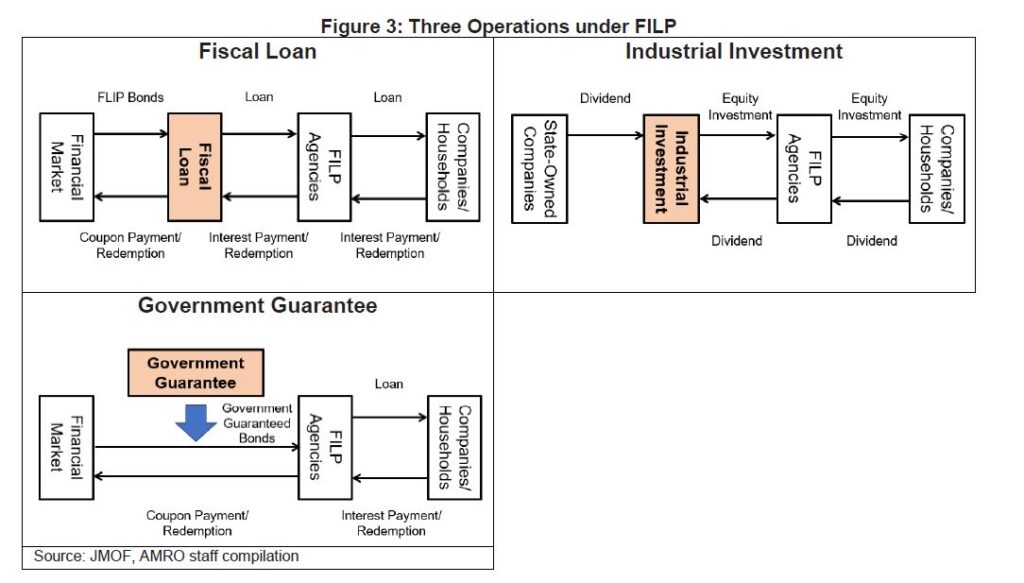

The FILP is implemented through FILP agencies such as government-affiliated financial institutions, using three financial instruments: (i) loan (Fiscal Loan); (ii) equity investment (Industrial Investment); and (iii) guarantee (Government Guarantee) (Figure 3).

A total budget of JPY16 trillion was allocated for the FY2023 initial FILP plan. The government does not rely on tax revenues for the FILP. Instead, it is primarily funded through the issuance of FILP bonds, which are JGBs whose proceeds are earmarked for lending to FILP agencies (FILP Loan) and redeemed using repayments from FILP agencies.

FILP’s impact on public debt

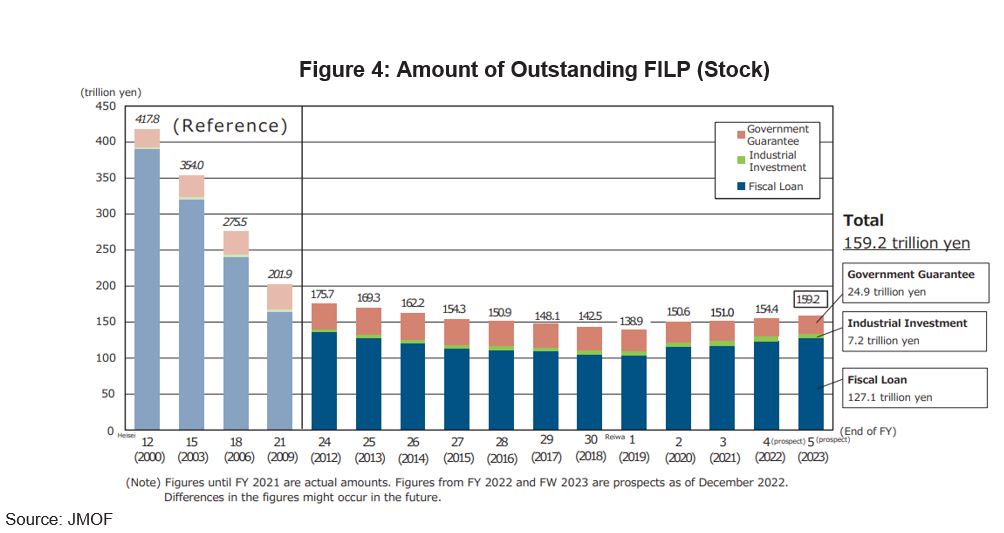

The issuance of FILP bonds and the provision of Government Guarantees carry the potential to increase public debt. That said, it is important to note that the FILP’s overall magnitude has remained relatively stable in recent years, and the proportion of government liabilities attributed to the FILP has stayed modest.

The stock of the FILP decreased significantly after the fundamental reform in FY2001. Before that, postal savings and pension reserves had been mandatorily deposited as a FILP source regardless of the actual funding needs, but now the government has to raise truly necessary amount of funds through issuance of FILP bonds. Over the past decade, the size of the annual FILP plan, including supplementary budgets, ranged from JPY15 to 20 trillion, except in FY2020 and 2021. During these years, the government increased the FILP plan to JPY66 trillion and JPY43 trillion, respectively, in response to the pandemic’s impact on companies.

However, only 30-40 percent of the planned amount was disbursed. As a result, the balance of FILP has been relatively stable at around JPY150-160 trillion over the past few years, including during the pandemic period (Figure 4). Given the total balance of JGBs as of end-FY2023 was estimated to be around JPY1,200 trillion, the share of the FILP balance remains relatively modest.

Efforts to improve transparency and efficiency

The FILP is subject to thorough scrutiny by the National Diet and the government. But criticism exists concerning its transparency and efficiency, primarily attributed to the fact that its operations are conducted through government affiliated FILP agencies. Ongoing initiatives are underway to enhance transparency and bolster risk management within the FILP framework.

The formulation process for the FILP plan mirrors that of the general budget and other Special Accounts’ budgets, requiring approval from the National Diet following an assessment by the Ministry of Finance and other relevant ministries.

Additionally, the FILP undergoes monitoring by an advisory panel comprising external specialists from academia, media, and relevant industries. Monitoring reports and discussions within the panel are disclosed to the public. For instance, the panel released a report addressing underperforming FILP agencies in June 2019, recommending measures to enhance investment principles and governance for these agencies.

Furthermore, the FILP’s asset liability management has been improved by reducing the duration gap between the assets (FILP loans) and liabilities (FILP bonds) and by making provisions against potential future losses resulting from interest rate fluctuations.

Traditionally, Japan’s Special Accounts and the FILP have attracted less public attention than the general budget. Given their significance in size and roles, more knowledge about these accounts and program is essential to better understand Japan’s fiscal system.