This article was first published in Project Syndicate on January 26, 2024.

During the pandemic, ASEAN+3 governments went all in to support their economies, not least by monetizing fiscal deficits. But pandemic-era policies must now be unwound against a backdrop of slower GDP growth, higher inflation, and increased debt.

Meanwhile, rapid digitalization – propelled partly by advanced technologies like generative artificial intelligence – is continuing apace, and the effects of climate change are becoming more visible by the day. Taken together, these developments pose major challenges to policymakers worldwide. Those in the ASEAN+3 countries – the ten ASEAN member states, plus China, Japan, and South Korea – are no exception.

During the pandemic, ASEAN+3 governments went all in to support their economies, not least by monetizing fiscal deficits – a taboo in normal times. The unprecedented fiscal stimulus they pursued – including large amounts of direct assistance to households and firms, from cash handouts to fuel subsidies – was accompanied by large interest-rate cuts. For example, in the Philippines, cumulative cuts in the policy rate reached 200 basis points in 2020. Governments also pursued policies like debt moratoria and regulatory forbearance.

In the post-pandemic era, these measures are excessive, imprudent, and unsustainable. But lower growth, higher inflation, and more public debt – which surged from around 93% of GDP, on average, in 2019 to 100% in 2022 in ASEAN+3 economies – makes unwinding them difficult. Doing so while addressing the multifaceted challenges that lie ahead will require a carefully crafted mix of policies, tailored to specific economies’ needs.

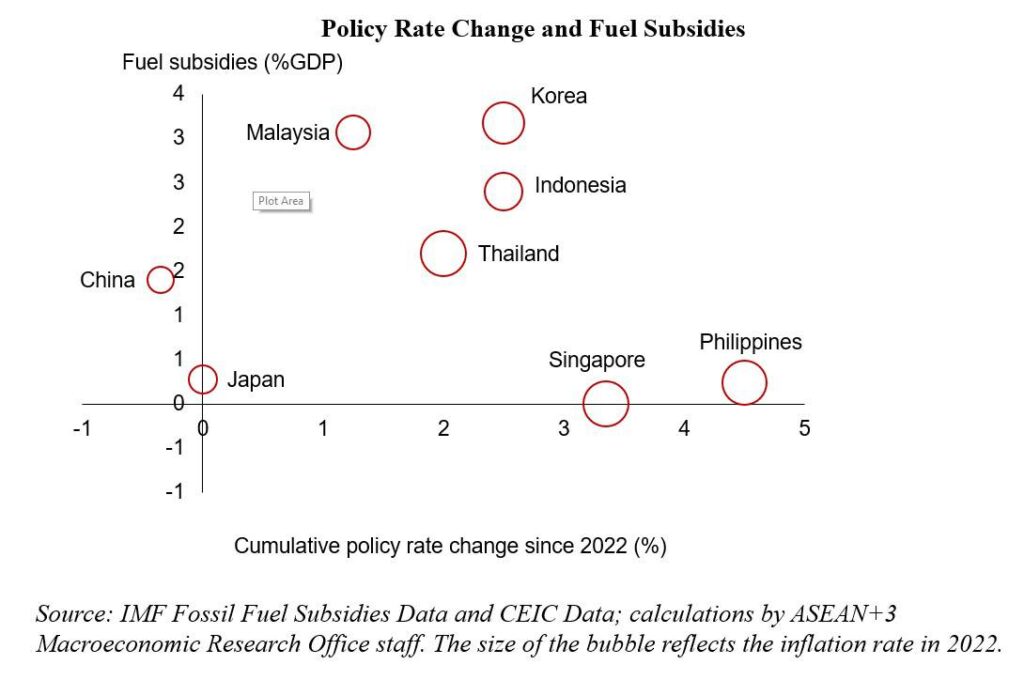

ASEAN+3 policymakers seem to recognize this. As the chart shows, despite facing broadly similar challenges, these governments have emphasized different measures, depending on their economy’s circumstances and policy space. For example, countries like Singapore and the Philippines sought to tackle inflation primarily through aggressive monetary tightening, with the former using exchange-rate targeting to reduce imported inflation.

By contrast, Indonesia, Malaysia, South Korea, and Thailand pursued more gradual interest-rate hikes, and used fuel and food subsidies to keep inflation in check. Meanwhile, China (where inflation remains low, and the post-pandemic recovery has been slower than expected) and Japan (with structurally low inflation) upheld accommodative policies.

ASEAN+3 countries also intervened in foreign-exchange markets. As the US Federal Reserve aggressively raised interest rates, fueling expectations that rates would remain higher, the US dollar appreciated, especially against currencies of countries with larger interest-rate differentials. Since rapid currency depreciation can compound inflationary pressure, making it harder for firms and households to adjust, several ASEAN+3 central banks used their international reserves to bolster their currencies.

But policymakers were careful not to overdo it, and retained sufficient international reserves to meet their external obligations. More broadly, they seem to have managed to limit the fallout from pandemic and inflation shocks, and, overall, ASEAN+3 remains a bright spot in the global economy.

This success has come at the cost of reduced policy space, however, and to withstand future shocks, ASEAN+3 countries must now rebuild it. To this end, they should embark on fiscal consolidation and end regulatory forbearance, debt relief, and other extraordinary policies and programs introduced during the pandemic.

Many ASEAN+3 economies have already committed to rebuilding their fiscal space. Singapore has raised several taxes, including its Goods and Services Tax, and Indonesia has implemented a comprehensive tax-reform package which includes a 2% increase in its value-added tax. Malaysia is rolling back broad-based subsidies in favor of more targeted support. And the Philippines has adopted a medium-term fiscal framework.

But there is much more to be done. In the short term, two priorities stand out: strengthening balance sheets in both the public and private sectors, and building up financial buffers.

Though financial sectors in the ASEAN+3 countries remain stable, with ample liquidity and capital buffers, there are pockets of weakness in some economies, and in many, debt stocks have risen uncomfortably close to the threshold of sustainability. Macroprudential policies – such as capital requirements, loan-to-value ratios, and debt-service ratios – should be implemented or strengthened, and weak banks should be recapitalized. Some countries have already been pursuing debt restructuring, in order to ensure that viable borrowers can survive as debt-relief programs expire.

ASEAN+3 policymakers must also address longer-term structural challenges. Greater regional integration is essential, as it would increase countries’ resilience to the forces of fragmentation, reinforce efforts to mitigate climate change, and improve efficiency and productivity through faster digitalization. Some countries might need infrastructure development, labor-market reforms, industrial policies, regulatory changes, and a concerted effort to boost foreign direct investment and trade.

The ASEAN+3 countries should waste no time preparing for the formidable challenges they face. The outlook for the global economy depends on their success.