Author: Hoe Ee Khor, Chief Economist

Will 2020 prove to be another challenging year for the region’s economies, or is a silver lining beginning to emerge amid moderating headwinds? What will be the main risks to growth and possible mitigating factors in the coming months? As we usher in the New Year, let’s take a look at the key trends that will shape the regional economic outlook in 2020 and beyond.

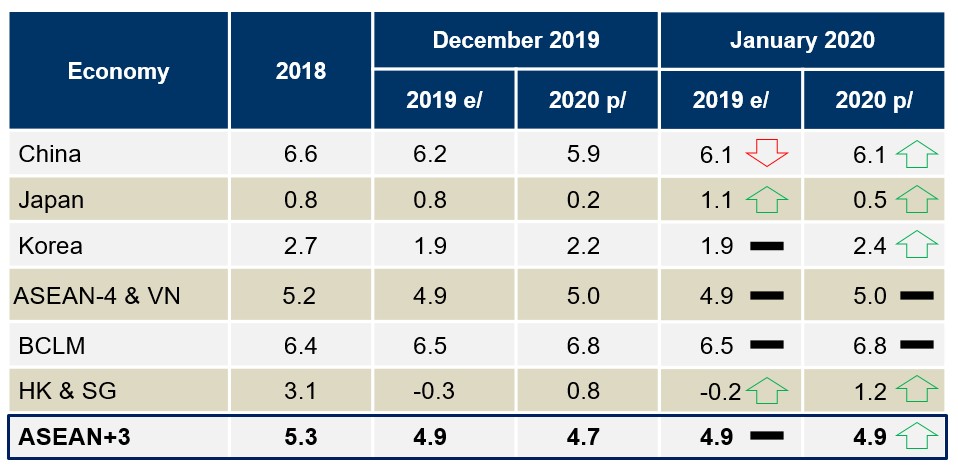

1. Positive developments for ASEAN+3 growth: With the recent progress in the US-China trade talks and the signing of the Phase One deal, we expect the region, which comprises 10 ASEAN member nations and China, Japan, and Korea, to grow by 4.9 percent in 2020, amid resilient domestic demand and improving manufacturing activity indicators. This is an upward revision to our projection in December 2019.

AMRO’s Growth Projections

December 2019 versus January 2020

Sources: National Authorities; and AMRO staff projections for December were made at end-November.

Note: e/ refers to AMRO estimates and p/ refers to AMRO projections. Japan data are for calendar year.

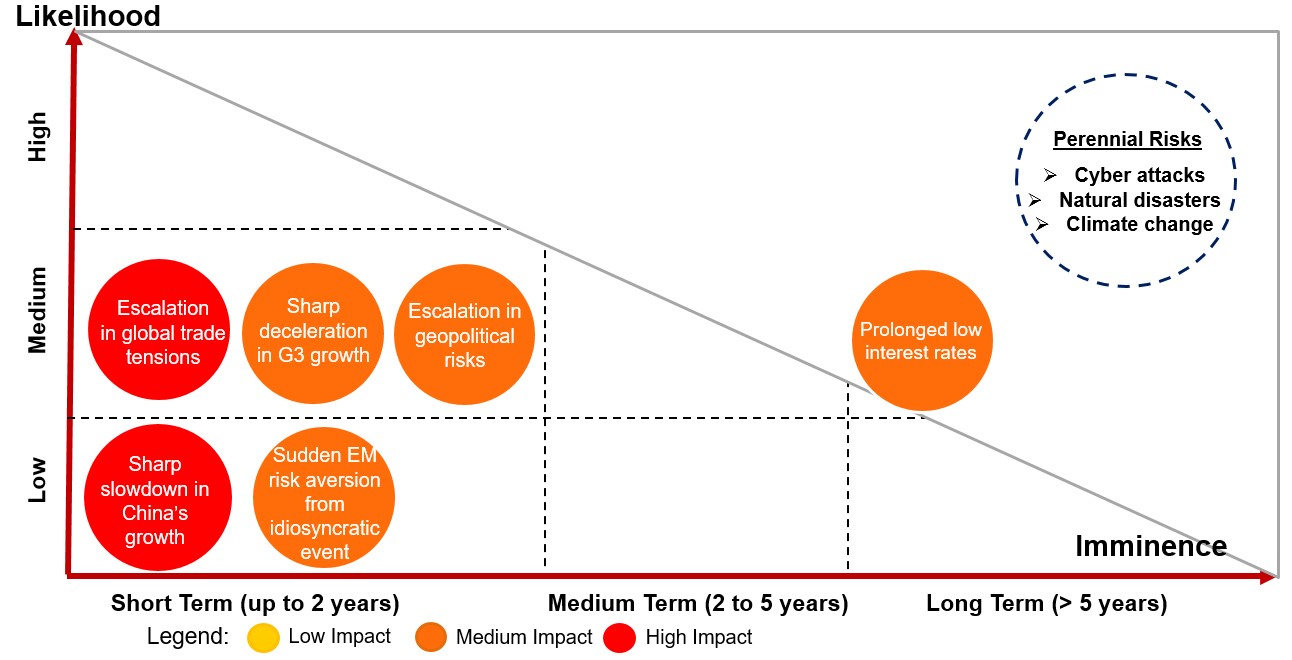

2. Cautious optimism: Nonetheless, risks that can derail the region’s tentative recovery remain. They include a re-escalation in global trade tensions, a sharper-than-expected slowdown in the G3 economies (Japan, Eurozone, and the US), and an intensification of geopolitical risks, with implications for oil prices. Moreover, regional policymakers need to be mindful that prolonged low interest rates could lead to a buildup of financial vulnerabilities over time.

AMRO’s Global Risk Map – January 2020

Source: AMRO staff estimates.

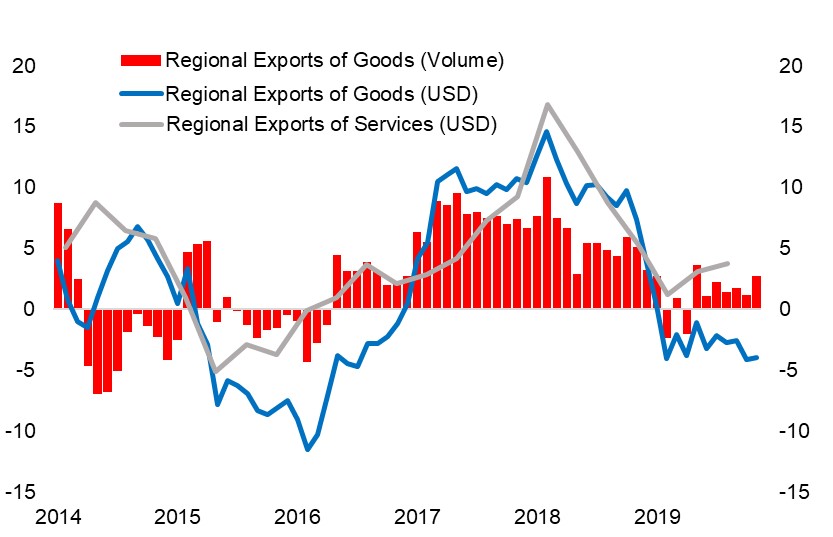

3. Easing trade tensions a boon for exports: As anticipated, aggregate regional exports have been hurt by the US-China trade tensions, although growth in services exports is still positive. However, some economies in the region were able to benefit from increased exports of goods that were diverted away from China. With the recent signing of the Phase One deal, downside risks to the trade outlook have subsided somewhat, and the easing trade tensions and the recovery in semi-conductor cycle provide an upside to the region’s exports in 2020.

ASEAN+3: Regional Export Performance

(Percent year-on-year, 3-month moving average)

Sources: Haver Analytics; National Authorities; and AMRO staff calculations.

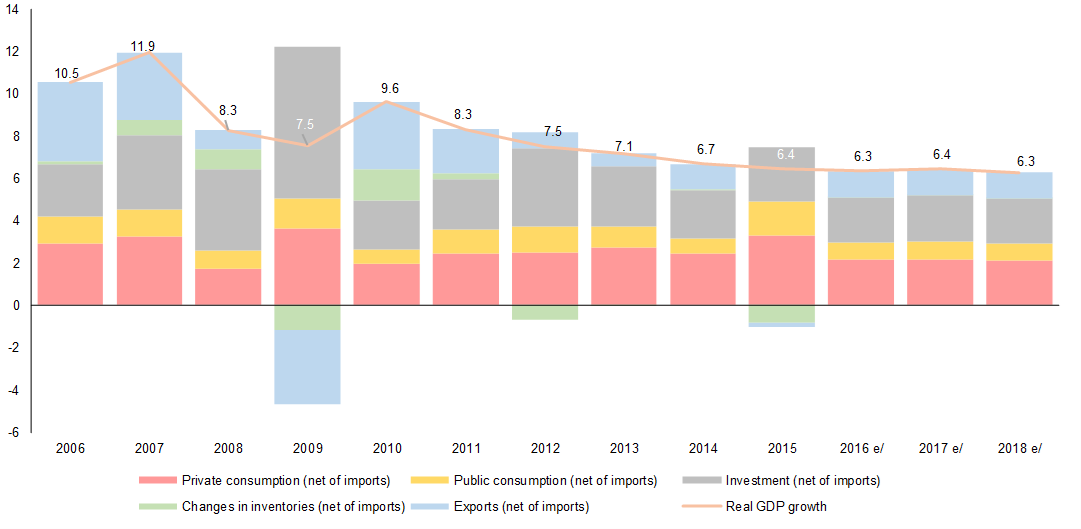

4. Domestic demand the major driver of growth: Domestic demand in ASEAN+3 economies anchored and supported growth in 2019, in the face of strong external headwinds. Moving forward, ASEAN+3 economies will likely depend increasingly on domestic demand to sustain solid and resilient growth. The region’s rising middle class is expected to underpin robust and healthy consumption, while efforts to improve the quality of infrastructure to enhance competitiveness and connectivity should see a sustained increase in investment.

ASEAN-4, Vietnam, China: Contributions to Growth, Import-adjusted Method

(Percentage points)

Sources: National Authorities; OECD and AMRO staff calculations.

Note: ASEAN-4 refers to Indonesia, Malaysia, Philippines, and Thailand. OECD IO Tables are only available from 2005 to 2015. Therefore, 2016–2018 estimates are based on 2015 shares.

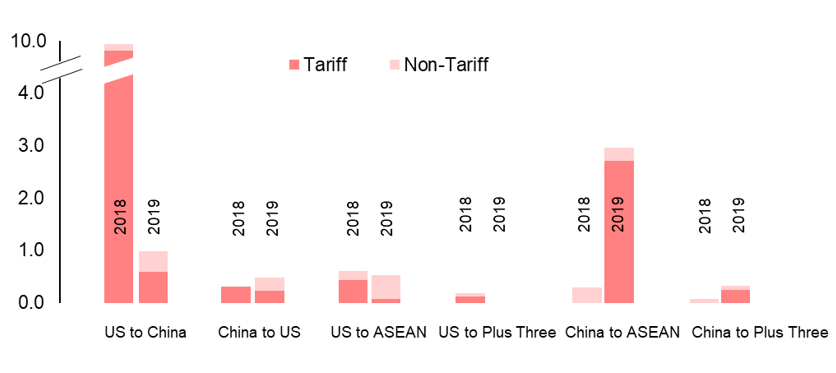

5. The rise of trade and investment diversion: While some regional economies have been hard hit, others have benefited from the US-China trade tensions. The latter have become alternative sources of goods and foreign direct investments (FDI) markets for investors. FDI via co-location—that is, when a company moves some of its operations to another country where it has an existing facility—has risen significantly in the last two years. There was a sharp jump in US announcements of co-locations towards China in 2018, as well as announced co-locations from China to ASEAN in 2019. Not surprisingly, these movements were mostly seen in tariff-hit sectors, especially in chemicals, transport, and electronics.

Global Co-locations by FDI Direction

(Announced, billions of US dollars)

Source: Orbis Crossborder (as of November 25, 2019).

Note: Co-location is the moving of operations to complement the activity in an existing location; FDI data comprise announcements and reports of relocations and co-locations.

To sum up, we expect the ASEAN+3 region to remain resilient in 2020, despite downside risks. And should any of the potential risks materialize, the region’s economies have sufficient reserves and exchange rate flexibility to withstand these challenges. Encouragingly, regional policymakers still have some room to adopt more accommodative monetary and fiscal policies, while at the same time maintain tight macroprudential policy to safeguard growth and financial stability.

What’s your view on the economic outlook for the ASEAN+3 region in 2020? Share with us in the comment section below!