The last decade saw an acceleration in Japanese companies shifting their business model further from export-oriented domestic production toward foreign direct investment or FDI-driven overseas production. However, Japan’s overseas investment expansion is now challenged by the COVID-19-led economic downturn.

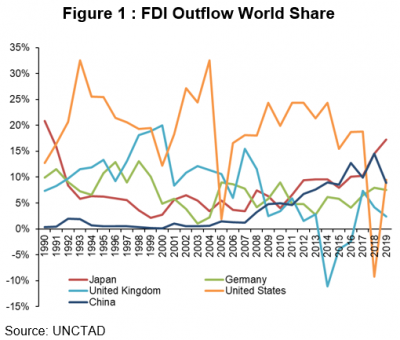

In 2018, Japan became the world’s biggest source of FDI for the first time in almost 30 years (Figure 1). Its outward FDI reached a record high at about USD 250 billion in 2019, accounting for 17 percent of global FDI.

Domestic Factors Pushed Outward Investments

AMRO’s 2019 Annual Consultations Report on Japan underscores the driving factors that pushed Japanese companies’ outward FDI have varied over the years.

After the Plaza Accord of 1985, the Japanese Yen appreciated sharply against the U.S. dollar from an average of 238 JPY/USD in 1985 to 138 JPY/USD in 1989. In response, Japanese companies shifted production overseas to reduce cost, driving Japan’s FDI outflows to become the highest in the world. However, this trend was reversed following the collapse of the Japanese asset bubble in the early 1990s, and Japan’s FDI outflows remained relatively low until after the Global Financial Crisis (GFC) when it began to rise again.

The FDI outflows since the GFC have been spurred by Japanese firms’ search for profit and markets overseas, especially in countries with large and growing domestic markets, to cope with shrinking domestic market amid a rapidly aging population and an ultra-low interest rate environment in Japan.

The overseas investments by Japanese companies have been facilitated by cheap funding options, given the ultra-low interest rate environment.

Moreover, the pressure from shareholders for higher returns is rising on the back of recent regulatory reform on corporate governance. Although Japanese companies have been accumulating cash in recent years, they have been pressured by the reform to make better use of capital by investing abroad.

Surge in Cross-border Mergers and Acquisitions

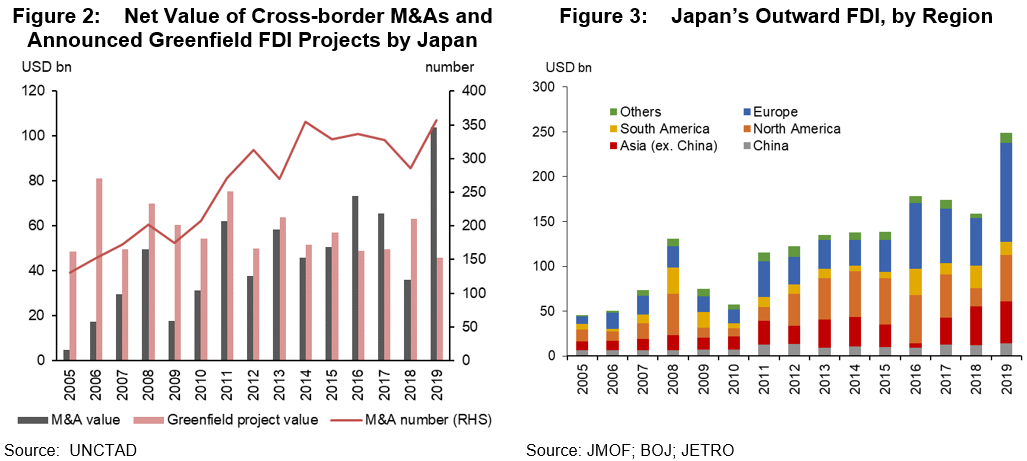

Cross-border mergers and acquisitions (M&As) have become a key driver of the increase in FDI outflow, while the total value of FDI in greenfield projects has also remained high over the past decade. The average number of cross-border M&As by Japanese companies in the 2010s more than doubled from the average level in the 2000s (Figure 2).

Corporates pursue cross-border M&As for various reasons. A company may wish to acquire existing distribution channels, talents, or technologies in another company that can create synergies with its own business. It may also be seeking to secure a bigger global market share or an established brand.

Recently, Japanese companies’ major deals have been mainly in consumer businesses, including food and beverages and financial services, reflecting shrinking opportunities in the domestic market.

A large portion of Japan’s FDI outflows were headed to North America and Europe in a bid for M&A opportunities in companies with stable cash flows, strong brand recognition, and access to large, growing markets (Figure 3). In addition, research and development bases in these regions make them attractive destinations for investment.

Excluding China, FDI outflows to Asia have also increased steadily over the years. Although the region has long been an important destination for Japanese companies due to low labor cost, the shift towards Asia (ex-China) has accelerated recently as a result of the “China plus one” strategy that was newly adopted by many Japanese companies. This strategy encourages Japanese firms to diversify their production line to mitigate risks arising from an over-reliance on China. Japanese companies also want to tap into Asia’s dynamic economies, which have been driving global growth.

Japan’s Outward FDI During and After the Pandemic

The COVID-19 pandemic has cast a shadow over the Japanese corporates’ operation and business strategy alike. The disruptions in the global supply chains during this pandemic have prompted many of them to ask whether they should expand overseas investments or consider inshoring.

In addition, the pandemic-induced economic recession is expected to weaken the balance sheets of the companies, which may deter them from making further investments.

The United Nations Conference on Trade and Development (UNCTAD) has forecast that global FDI would decrease by 40% in 2020. Under the circumstances, the overall outward FDI by Japanese companies can also be expected to shrink as these firms might adopt a wait-and-see approach.

However, this approach may not apply across all sectors. In August, Seven & I Holdings, a Japanese leading retail company, announced a USD 21 billion M&A deal. This indicates that Japanese companies that hold big cash reserves and that are less impacted by the pandemic might consider the current environment as an opportunity to make new deals.

Lastly, given Japan’s aging population and low-interest-rate environment, Japanese companies are likely to resume overseas expansion in the medium term as a growth strategy.