This article was published as an op-ed in The Scoop on January 17, 2022

As a resource-rich country, Brunei Darussalam’s economy depends heavily on developments in the oil and gas sector. The Bruneian authorities have — for the last few decades — recognized the importance of diversifying their economy to build resilience, and had planned since the late 1990s to expand the main economic drivers to non-resource sectors.

While Brunei has made progress in economic diversification in recent years, the country remains less diversified than other resource-rich economies, such as the United Arab Emirates, Indonesia, and Malaysia. AMRO’s just released annual consultation report on Brunei says that the country will need a strategic plan that broadens its sources of income beyond oil because according to the BP Statistical Review of World Energy 2021, Brunei’s oil reserves will likely run out in 27 years. The country’s income is derived largely from oil exports.

As a high-income economy, Brunei’s diversification strategy should focus on high value-added sectors such as information and communications technology and creative industries, as well as business and financial services.

To establish a strategic development plan, the country should formulate policy in terms of coordinating different measures. For example, fiscal expenditures and tax incentives could prioritize providing an expenditure program that helps grow certain high value-added industries.

The authorities can also encourage diversification through foreign direct investment incentive schemes, and set up joint ventures to accelerate infrastructure construction, particularly in relation to logistics to support the export of non-oil and gas products.

Human capital is essential in promoting high value-added industries and the services sector. The Bruneian government should improve the matching of skills and education with the requirements of such diversification.

Brunei should also take a unified and strategic approach toward the development of the micro, small and medium enterprise (MSME) segment of the economy. For example, the financial support scheme for MSMEs could prioritize loans for those in high value-added sectors, and taxation policies can be designed to lower the business costs of MSMEs in the same sectors.

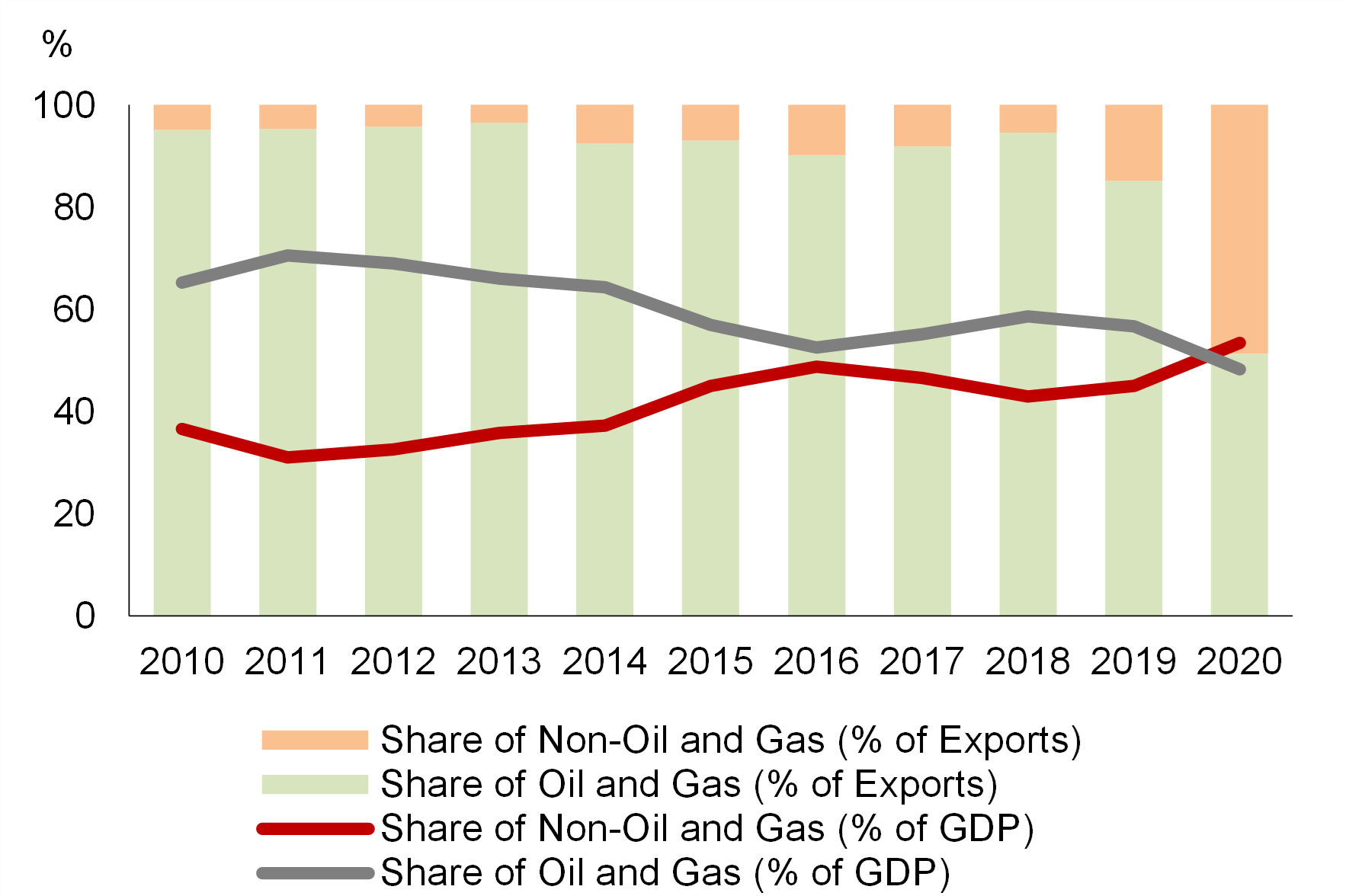

Lastly, we commend the authorities for their efforts in economic diversification in the past decade, which was partly supported by the strong fiscal reserves accumulated from the oil and gas revenues. Brunei achieved a major milestone in economic diversification in 2020 with the establishment of Hengyi Industries and its commencement of operations in late 2019. Hengyi produces petrochemical products using mostly imported oil, a diversification into downstream activities. The company’s petrochemical exports and the sharp drop in global oil prices last year led to the non-oil and gas sector making up more than 50 percent of nominal GDP for the first time on record (Figure 1). The country’s share of non-oil and gas exports also increased significantly to 48.6 percent in 2020 from 14.8 percent in 2019.

Figure 1. Oil and Gas Sector Share in GDP and Total Exports

Note: GDP in current prices

Source: DEPS; AMRO staff calculations

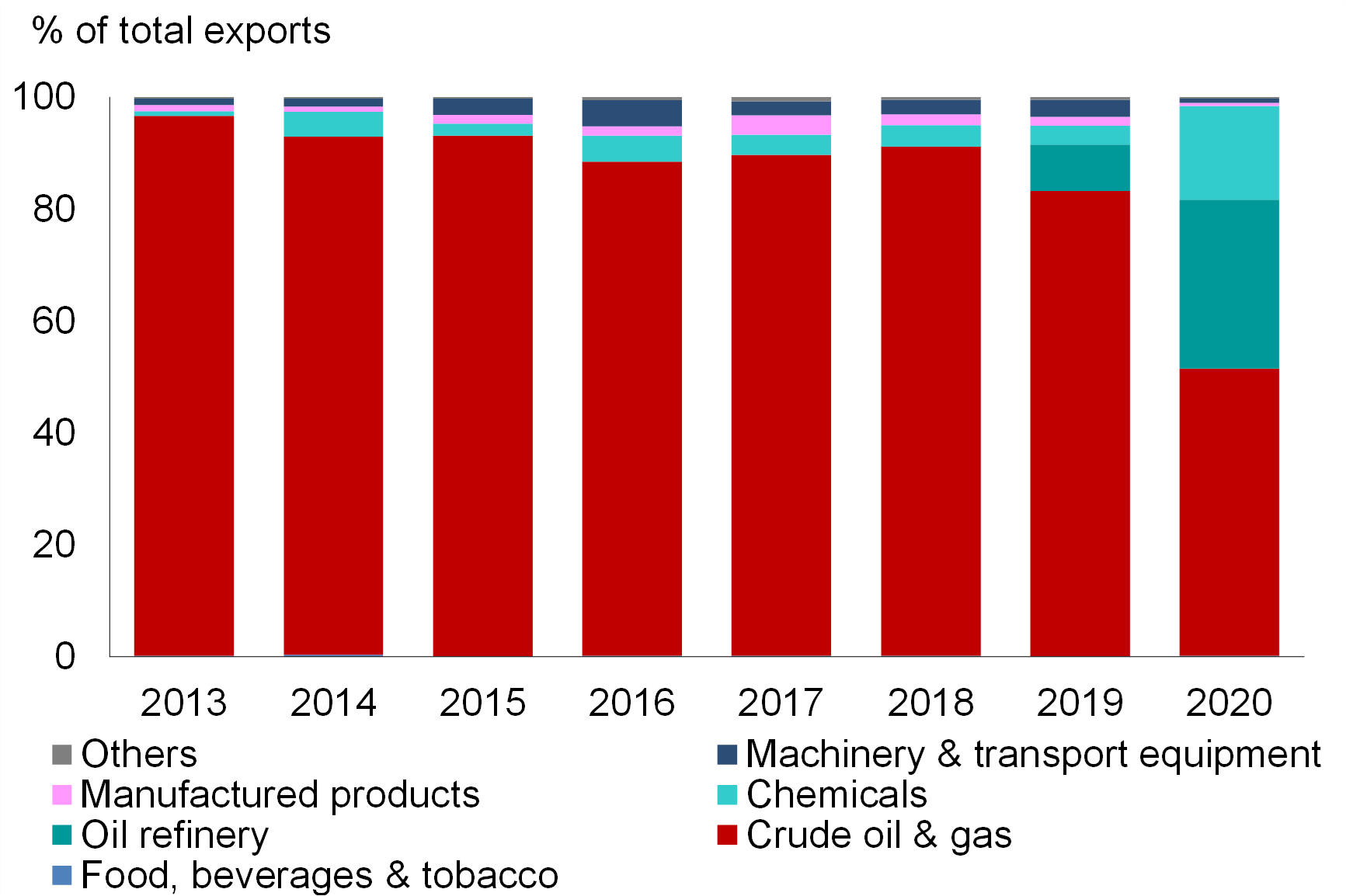

The export of petrochemical products has allowed the economy to expand from mainly upstream to both upstream and downstream production. Nevertheless, crude oil and gas is still the largest component of Brunei Darussalam’s exports (Figure 2). In addition, while Brunei considers Hengyi’s petrochemical products as part of the non-oil and gas sector, such products are still related to the oil and gas industry.

Note: Exports of oil refinery are AMRO staff estimates given data unavailability.

Source: DEPS; AMRO staff calculations

Brunei’s revenues continue to be highly dependent on the oil and gas industry, and the economy as a whole is vulnerable to fluctuations in global energy prices and the steady depletion of oil reserves. A much greater diversification of the economy cannot come soon enough.