Global concerns over climate change have been growing in recent years due to more extreme climate-related events which have increased in likelihood and intensity, prompting stronger climate actions worldwide. Although the climate-related natural hazard risk of Brunei remains low, and below the world average, the climate transition risk is perennial. In the recently published 2022 Annual Consultation Report on Brunei Darussalam, AMRO made some suggestions on how to better address the climate change challenges in the country.

Climate change policy framework

Recognizing the risks from climate change, the authorities unveiled the Brunei Darussalam National Climate Change Policy (BNCCP) in 2020 with clear strategies, action plans and milestones with the aim of achieving a sustainable, low-carbon and climate-resilient country by 2035. These 10 strategies are long-term goals, and many of them are at the study stage (Figure 1).

Given the multi-year economic and social impact of climate change, tackling it requires not only strategic policy design and implementable action plans, but a holistic approach. In this respect, mainstreaming the national climate action plans into the multi-year national development plans would help strengthen the longer-term economic, social and environment agenda. An integrated approach toward tackling climate change would also help maximize cross-sector complementarity — such as in the area of finance, where financing of climate-related projects would help foster domestic capital market developments, which in turn drives economic growth.

Figure 1. Ten Strategies of the BNCCP and Examples of Performance Indicators

Source: Brunei Climate Change Secretariat (BCCS)

Fiscal Strategies

On the fiscal front, given the threats of extreme weather events, the government must consider spending pressures through physical damage and the impact on the country’s fiscal position.

The systematic identification and costing of climate change programs, particularly in the area of adaptation, in the longer-term budget planning would help strengthen public financial management and ensure coordination of various policies in supporting common national objectives.

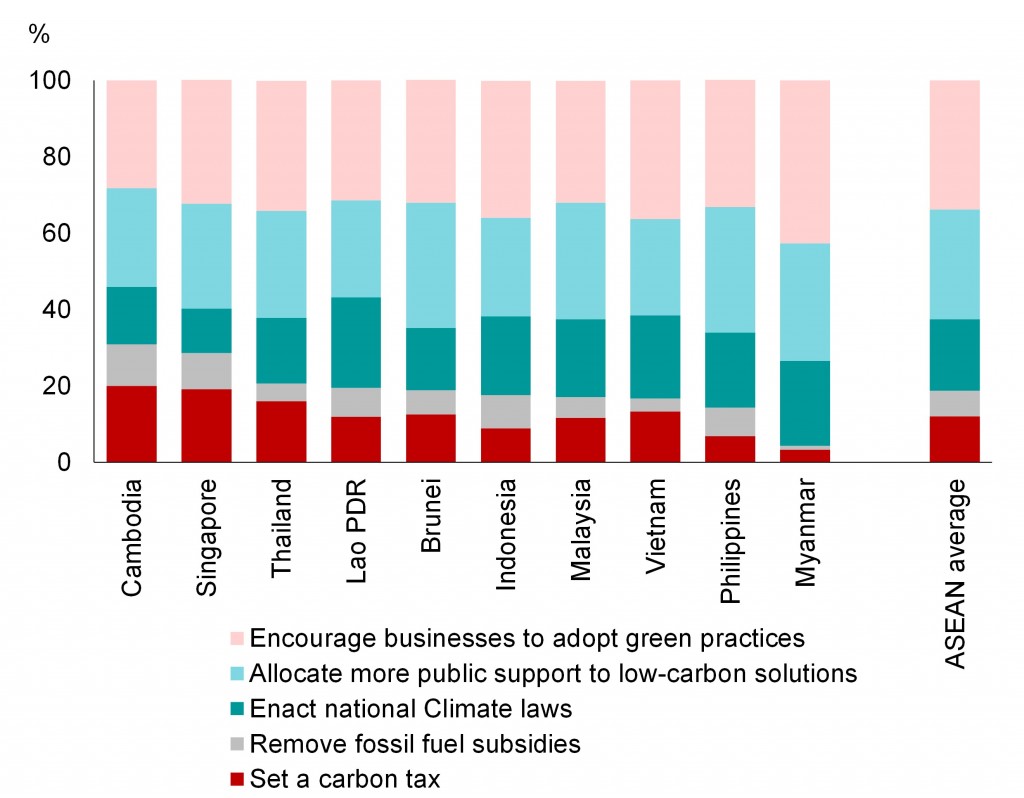

In the area of mitigation, Brunei could consider inducing carbon tax at low rates. According to a survey by ISEAS–Yusof Ishak Institute (Figure 2), the percentage of those who consider the introduction of a carbon tax as an important policy priority to reduce carbon emissions is relatively higher in Brunei compared to other regional countries. The adoption of a carbon tax could also provide another source of funding to the government.

Fiscal policy could also incentivize clean energy transition, helping to accelerate the achievement of national climate goals, for example through the introduction of electric vehicles (EVs). Although Brunei launched a two-year pilot program for EV adoption in March 2021, the EV deployment in Brunei is still at a nascent stage, with only 19 EVs registered until August 2022. To further promote the use of EVs, fiscal incentives, such as tax relief for the purchase of EVs, or road tax exemptions for them, would have to be aligned with fuel subsidy policies, which incentive the purchase of fossil fuel cars.

Figure 2. Selected ASEAN+3 Economies: National Climate Change Policy Priorities to Reduce Carbon Emissions (Poll Results)

Source: The Climate Change in Southeast Asia Programme at ISEAS–Yusof Ishak Institute (formerly Institute of Southeast Asian Studies)

Financial Strategies

The implementation of climate action plans involves substantial upfront costs, and the private sector has an important role to play. To attract private sector interests, it is essential for Brunei to first develop certain niche markets and instruments that would appeal to private investors.

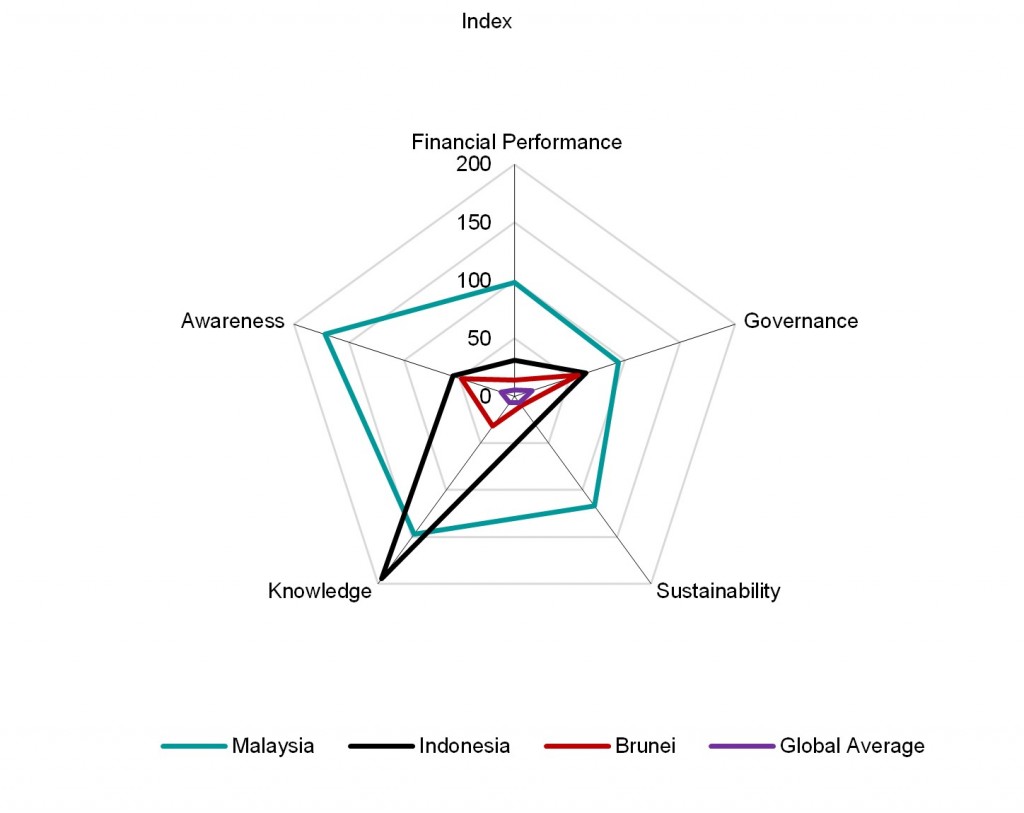

One recommendation is for Brunei to leverage the opportunities from Islamic finance by harnessing the promise of green sukuk (Islamic bond) in spearheading the financing of climate action plans. This would help develop the domestic Islamic capital market and reduce the dependency on the banking system, providing an alternative avenue for long-term financing. According to Refinitiv, Brunei ranks 12th globally in Islamic Finance Development Indicator (IFDI), with high scores for governance and awareness but low scores for financial performance (Refinitiv 2021)(Figure 3). This underscores the growing interests of capitalizing on green bonds or green sukuk to finance renewable energy projects, which is a strategic area that the nation is working on, as outlined in the BNCCP. The issuance of green sukuk could support renewable energy projects such as solar power stations and increase the use of renewable energy.

Looking ahead, tackling climate change challenges requires a multifaceted approach—one that is integrated with longer-term fiscal and financial strategies. This calls for the implementation of climate action plans that is coherent and synergistic with long-term national development agenda in order to achieve sustainable outcomes.

Figure 3. Islamic Finance Development Indicator (IFDI), 2021

Source: Refinitiv, AMRO staff calculations

Notes: The higher the IFDI score, the better the performance. The IFDI is an index that measures the overall development of the Islamic finance industry of 136 countries globally. It measures the performance of Islamic banks, takaful, other Islamic financial institutions (OIFIs), sukuk, and Islamic funds. The database includes the information of more than 560 Islamic banks, 330 takaful entities, 4,400 sukuk, 1,900 Islamic funds and 770 other Islamic finance providers.