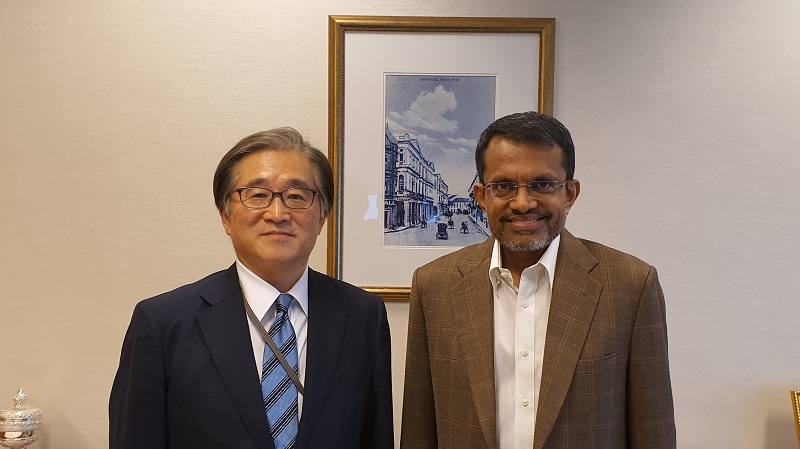

AMRO Director Mr. Toshinori Doi (left) pays a visit to Managing Director of the Monetary Authority of Singapore (MAS) Mr. Ravi Menon during the Annual Consultation Visit to Singapore in December 2019.

SINGAPORE, December 19, 2019 – Singapore’s economy is expected to recover gradually from the sharp downturn in 2019, which was caused by the U.S.-China trade tensions and global economic slowdown. Policymakers have ample policy space and are well prepared to face these external headwinds. This is according to the preliminary assessment by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit to Singapore from November 18 to December 11.

The mission was led by AMRO Lead Economist Dr. Chaipat Poonpatpibul, and key policy meetings were participated by Director Mr. Toshinori Doi, and Chief Economist Dr. Hoe Ee Khor. The discussions focused on economic prospects, challenges ahead, and policy responses.

“Singapore’s growth is expected to slow to 0.6 percent in 2019, before picking up to 1.1 percent in 2020, reflecting continued weakness in the global economy,” said Dr. Poonpatpibul. “There are signs of bottoming out in the semiconductor exports, which could help support exports and the economy ahead. Uncertainties over the U.S.-China trade tensions remain the key risk to growth.”

AMRO Director Mr. Toshinori Doi (second from right), Chief Economist Dr. Hoe Ee Khor (first from right), and Lead Economist Dr. Chaipat Poonpatpibul (first from left), meet with Permanent Secretary Mrs. Tan Ching Yee (middle) and Deputy Secretary Mr. Yee Ping Yi (second from left) of the Ministry of Finance during the Annual Consultation Visit to Singapore.

Despite progress in the trade talks, policy uncertainty from the U.S.-China trade tensions remains elevated and is likely to continue to affect sentiments and business investments. However, financial, ICT, tourism-related services and construction have remained robust. The labor market has also been relatively resilient to the economic downturn.

The main risks to growth stem mainly from external factors, especially the U.S.-China trade tensions and a sharp global economic slowdown. In addition, Singapore is also facing challenges from cybersecurity threats, climate change, aging and geopolitical instability.

Monetary policy has been eased slightly in view of the economic slowdown and subdued inflation outlook. The Monetary Authority of Singapore (MAS) could consider further easing monetary policy if the global economic outlook continues to weaken or the trade tensions were to re-escalate, and lead to a broader and significant slowdown. More importantly, fiscal measures could be adopted to support the economy and the labor market.

Macroprudential measures should be maintained to prevent excessive price increases and mitigate the risk of a sharp price correction due to the sizable supply of private residential properties in the pipeline. If the private residential property prices were to rise more sharply, authorities could also consider further tightening of macroprudential measures and adjusting the supply of government land for private residential development.

In response to the long-term challenges, Singapore has continued to pursue multi-year restructuring efforts to enhance productivity. Towards this end, all 23 sector-specific Industry Transformation Maps are being implemented in a well-coordinated manner among different government bodies and stakeholders. Authorities are also providing incentives to further develop their digital and innovative capabilities as well as offering targeted training programs to reskill and upskill workers.

AMRO supports the authorities’ commitment and recent policy measures to address the aging population challenges by facilitating greater employment of older workers. Policies to pursue further structural transformation and increase investments in needed infrastructures are strategic and commendable. Further Fintech developments will also help enhance productivity in the financial sector, and boost Singapore’s competitiveness as an international financial hub.

AMRO welcomes the government’s greater fiscal spending to support Singapore’s growing socioeconomic needs. The initiatives on various socioeconomic fronts such as further improving housing affordability, increasing spending for aging-related healthcare, and enhancing accessibility and affordability of early childhood education, have been bolstered. Efforts to further strengthen social safety nets should continue.

It is commendable that policymakers have also strengthened cybersecurity risk mitigation efforts and stepped up initiatives to address challenges from climate change and develop green financing.

The mission team would like to express its appreciation to the Singaporean authorities for their assistance and warm hospitality. The consultation visit has deepened AMRO’s understanding of the country’s current macroeconomic and financial situations, as well as ongoing efforts to address the risks, vulnerabilities and challenges confronting the economy.

—

About AMRO:

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization, established to contribute to securing the economic and financial stability of the ASEAN+3 region, which includes 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO fulfills its mandate by conducting regional macroeconomic surveillance, supporting the implementation of the Chiang Mai Initiative Multilateralisation (CMIM), and providing technical assistance to its members.