This article was published as an op-ed in The Edge Singapore on November 25, 2021

While the world is grappling with disruptions in global supply chains due to the pandemic, exports of modern services, including telecommunications, information and communications (ICT), finance and insurance, and professional services, continue to flourish. In Singapore, the share of modern services exports rose from almost 30 percent in 2000 to 65 percent last year.

The growth of modern services exports has outpaced traditional services exports since 2000, driven by rising demand as well as sector-specific factors. As an international financial center, Singapore’s exports of finance and insurance services have been boosted by financial sector liberalization in major export markets. The rapid advancement in ICT has led to the fragmentation of job functions and the outsourcing of support services. Professional services, Intellectual Property (IP) rights and ICT exports have benefitted from the relocation of global business headquarters to Singapore and the nation’s role as an ICT hub.

Unlike the conventional type of services, modern services exports comprise services that can be rendered without close proximity between the service provider and customer. As a result, the sale of such services from Singapore to foreign countries was almost completely undented by the pandemic.

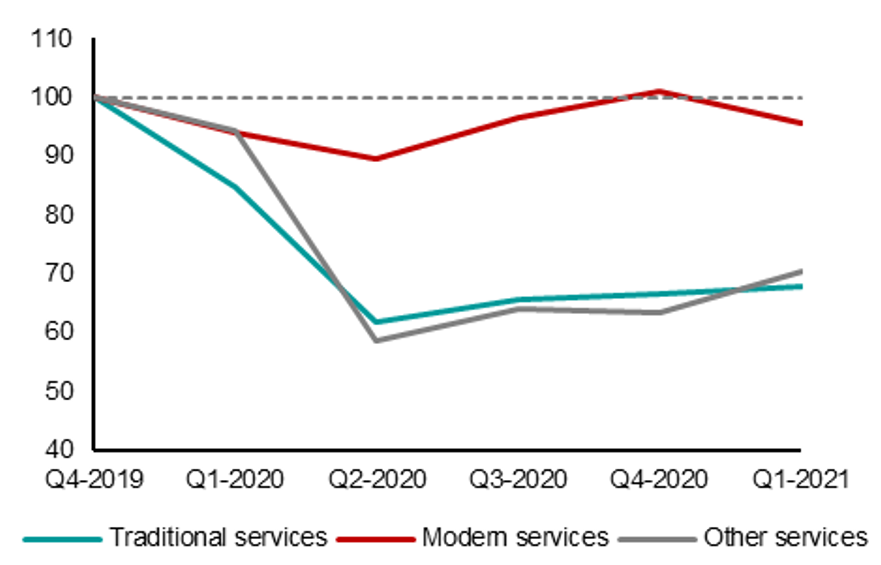

A study in AMRO’s 2021 Annual Consultation Report on Singapore noted that resilience to economic downturns is a notable characteristic of Singapore’s export of modern services. Export of modern services decreased in only four of the 13 quarters of economic contraction in the past two decades. Similarly, last year, the export of modern services declined slightly in the second quarter due to the Circuit Breaker, but quickly rebounded and reached pre-pandemic levels by the end of the year. In contrast, export of transportation and travel services remain far below pre-pandemic levels. Export of modern services consequently increased more than four-fold to 36 percent of GDP in the past two decades.

Figure 1. Exports of Services by Categories

(Index, Q4 2019 = 100)

Source: Singapore Department of Statistics via Haver Analytics; AMRO calculations.

Note: Other services refer to construction services, manufacturing services on physical inputs owned by others, maintenance and repair services, government services and personal, cultural and recreational services.

More room to grow and benefit from

With an uncertain outlook for the travel and tourism industry in the short term, growth in export of modern services would play a crucial role in supporting Singapore’s overall economic recovery and growth.

As the strength of modern services lies in its ability to create new services and solutions, Singapore should capitalize on its strengths in financial innovation, its skilled workforce, and dynamic technological ecosystem. These core competencies would enable the country to strengthen its foothold in new growth areas such as green financing, telemedicine, and consulting services on climate change management.

Given its strong linkages with the rest of the economy, expansion in modern services would also boost growth in the manufacturing sector, traditional services, and other modern services subsectors.

In our increasingly digitally-driven business environment, availability and access to quality modern services are crucial to all economic sectors. The enhancement of modern services exports would benefit the domestic economy by raising output, employment and wages in a wide range of downstream sectors. This current juncture presents a crucial opportunity to deepen linkages between modern services and the production sectors. At the same time, efforts should be intensified to strengthen local firms’ capabilities, particularly in the areas of professional, scientific and technical services.

Riding on regional demand

Singapore is also well placed to tap on the potential markets in the ASEAN+3 region – home to almost 30 percent of the world’s population. Currently, foreign demand for modern services from Singapore account for only about 60 percent of its output, markedly lower than that for traditional services or manufacturing activities at around 90 percent. Singapore’s exports of modern services to the ASEAN region has also been stable at 11 percent since the 2008 Global financial crisis.

The ASEAN+3 region’s expected strong rebound from the pandemic and its rising commitment toward a greener recovery present opportunities for Singapore’s modern services providers. Businesses can tap on the recently-signed multilateral trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) and ASEAN Trade In Services Agreement (ATISA) to reach a broader customer base. This would also increase intraregional trade and investment flows, deepening regional collaboration.

In a world increasingly driven by technology, modern services is to services exports what long-haul transportation was to goods exports. According to a report by McKinsey & Company, five years’ worth of digital adoption was achieved in only eight weeks during the pandemic. Providing international services via technology is easier, faster and safer than ever before. As economies strive to turn a pandemic fortuity into a lasting growth driver, Singapore must seize this opportunity to thrive in the new economy.