The COVID-19 pandemic triggered a sharp increase in the world demand for rubber gloves, notably medical gloves but also non-medical ones.

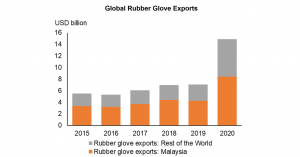

Malaysia recorded USD 8.4 billion worth of rubber glove exports in 2020, twice the value a year earlier (Figure below). As stated in AMRO’s Annual Consultation Report on Malaysia (2020), strong rubber glove exports were among the key drivers behind Malaysia’s resilient exports last year, when global demand for some of its traditional manufacturing and resource-based exports was adversely affected by the pandemic.

Source: Global Trade Atlas Database, AMRO Staff Calculation

Moving up the value chain

While the stellar performance of glove manufacturers made headlines during the COVID-19 pandemic, their success story is not new in Malaysia.

A typical rubber-related value chain consists of three segments. The upstream segment involves the cultivation of rubber plants and harvesting the latex; the midstream produces semi-processed rubber; while the downstream—the highest value-added in the chain—involves the manufacturing of final rubber products.

The history of the rubber industry’s upstream and midstream segments in Malaysia dated back to the colonial period. The downstream segment, meanwhile, took off only in the late 1980s, catalyzed by the demand for latex glove following the HIV/ AIDS epidemic.

Notably, home-grown firms, in close collaboration with public research and development institutions, led cutting-edge innovations, including the development of allergy-free latex medical gloves. They also pioneered the introduction of automation to production lines, which helped boost productivity to a significant extent.

Against these backdrops, Malaysian glove makers not only survived the 1997/98 Asian Financial Crisis, they thrived to become the largest suppliers to the world market today.

The country’s export of rubber gloves increased steadily over the years, making up half of its total exports of rubber products over the past decade. With a strong profit record, the industry, notably the rubber glove manufacturing segment, remains to be among key economic sectors in Malaysia today.

The country has also become the world’s largest glove exporter, accounting for about two thirds of the global market share, leading its runner-ups, Thailand (17 percent) and China (10 percent), by a wide margin.

Robust outlook

The booming demand for rubber gloves is likely to continue in the short term, driven by the ongoing COVID-19 pandemic and massive vaccination programs rolled out globally. It is estimated that the total volume of rubber gloves needed globally will grow at 15-20 percent per year for the next few years, up from less than 10 percent in the past decade.

Beyond the pandemic, the rising need for high-quality medical services in not only advanced economies but also developing countries, will likely sustain the global demand for gloves in the long run.

With strong production capacity and recent investment ramp-ups, Malaysian glove manufacturers are well-positioned to meet an increase in global demand. An estimated 240 billion pieces of gloves were produced in Malaysia last year to meet 70 percent of global demand. This is expected to increase further with expansion plans from both established firms and newcomers to the industry, eager to capitalize on the demand boom.

Challenges ahead

At the same time, the COVID-19 pandemic underscores a number of challenges faced by industry.

Despite increased automation, the industry remains labor-intensive and local firms rely heavily on foreign workers. However, international border shutdowns, caused by the pandemic, have made it difficult for firms to hire foreign workers.

Containment measures triggered by recurrent waves of infections have also led to the repeated suspension of operations in affected glove factories, highlighting the risk of output disruptions.

Furthermore, the pandemic has increased the volatility in rubber material prices. This could be critical for Malaysian firms due to their increased reliance on the import of rubber material inputs against the backdrop of a shrinking upstream segment.

Last, but not least, the living and working conditions of the factory workers have been in the international spotlight recently, raising concerns of major importing countries over the labor practices in the industry.

Further automation and modernization of the industry, and efforts to improve labor practices are vital for Malaysian glove makers to overcome these challenges. Such initiatives will help the industry not only to continue flourishing during the pandemic, but also to grow sustainably.