With many ASEAN+3 (comprising 10 member states of the ASEAN, and China; Hong Kong, China; Japan; and Korea) economies now fully reopening their borders, the region’s economic activity in the first half of 2022 has benefitted from a revival in domestic demand, supported by greater mobility and a pick-up in manufacturing.

Yet the region’s recovery remains fraught with uncertainty in the face of increasingly formidable global headwinds. Here are five key takeaways for the region’s outlook for 2022-23, as highlighted in AMRO’s latest ASEAN+3 Regional Economic Outlook.

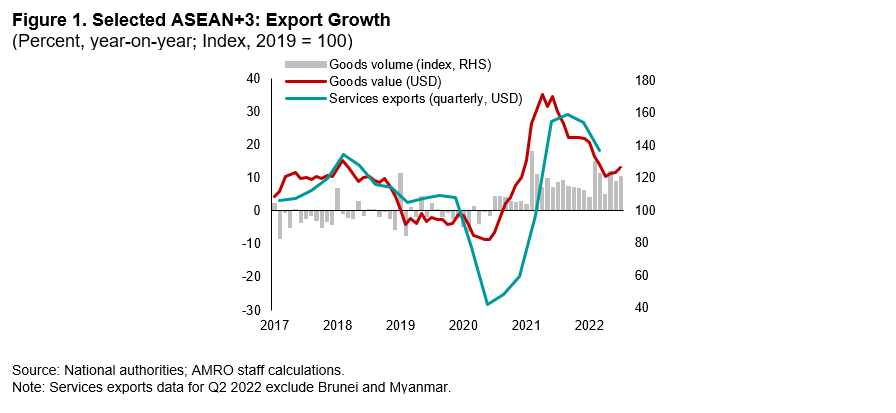

1. External demand is faltering. Growth in early 2022 was driven by robust domestic demand, while exports have also held up well, helped by easing of global supply chain disruptions and favorable commodity prices. However, weakening demand in China, Europe, and the United States is likely to hold back the pace of expansion. The July-September Purchasing Managers’ Index for new export orders already indicates slowing demand for key ASEAN+3 exports.

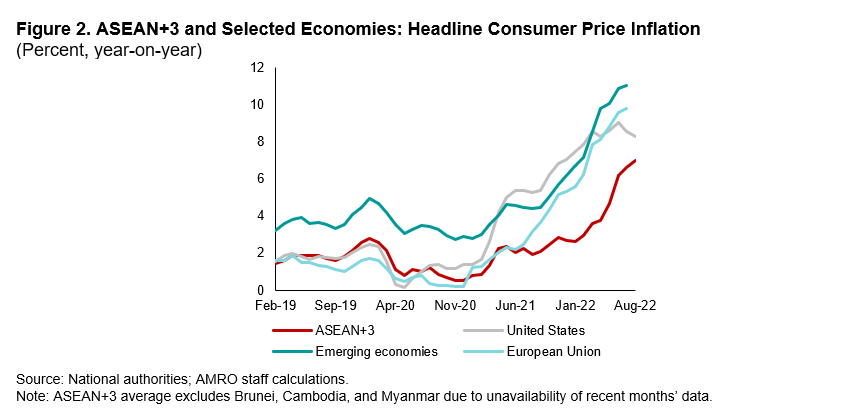

2. Inflation is still accelerating. Food and fuel prices across the ASEAN+3 remain high despite the decline in global oil and food prices from their peaks early in 2022. Subsidy cuts and weaker currencies have also pushed prices higher in some economies, while tighter labor markets and shrinking output gaps are putting upward pressure on inflation in others. Still, inflation in ASEAN+3 remains lower than elsewhere (Figure 2).

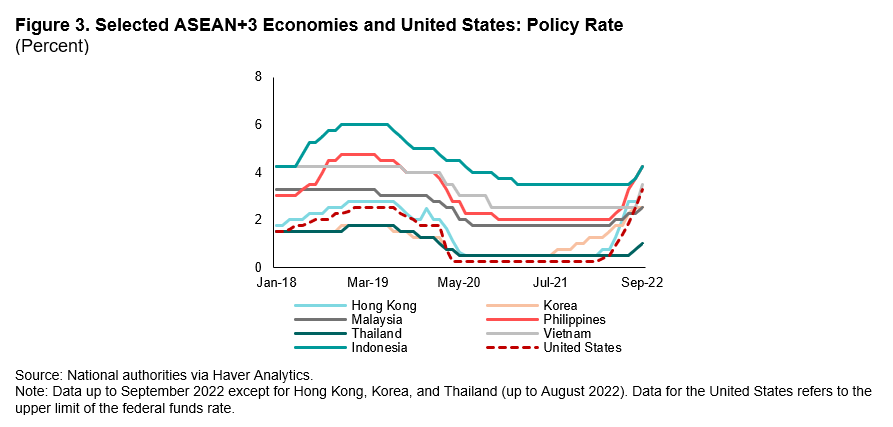

3. Financial conditions are tighter. Central banks in major advanced economies have been raising policy interest rates this year to tame inflation. The US dollar has hit its strongest level since the early 2000s. Across ASEAN+3, authorities continue to tighten monetary policy to curb soaring prices and support local currencies. As a result, financial conditions have tightened. Still, the pace of monetary tightening in the region is generally more measured and gradual to support economic recovery.

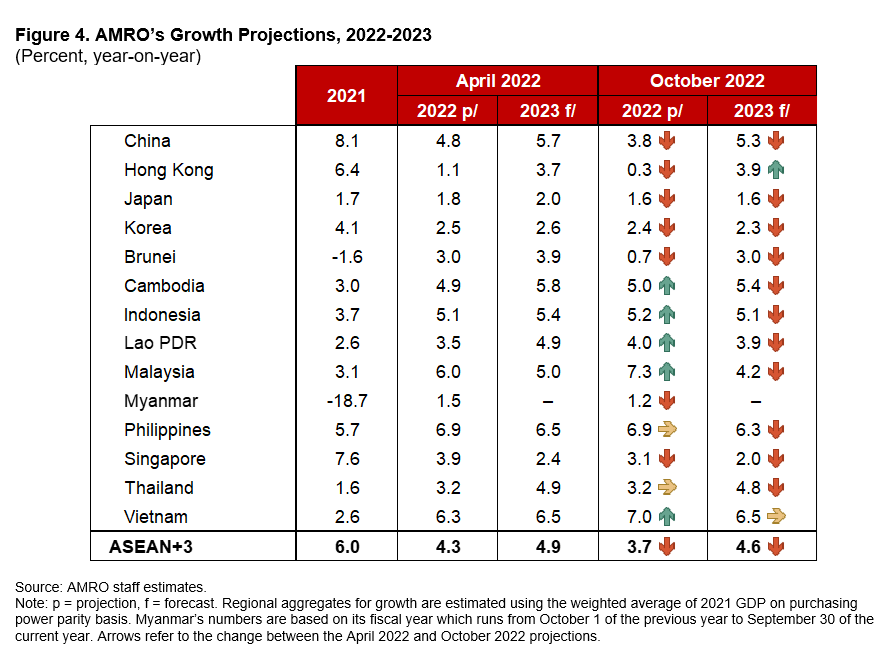

4. Weaker prospects lie ahead. The ASEAN+3 region is expected to grow at 3.7 percent in 2022, slightly lower than our previous forecast last July. This mostly reflects weaker growth in the Plus-3 (China; Hong Kong, China; Japan; and Korea) economies (Figure 4). China’s dynamic zero COVID policy and the slowdown in the property sector, as well as potential recessions in the United States and Europe, are weighing heavily on the region’s short-term outlook.

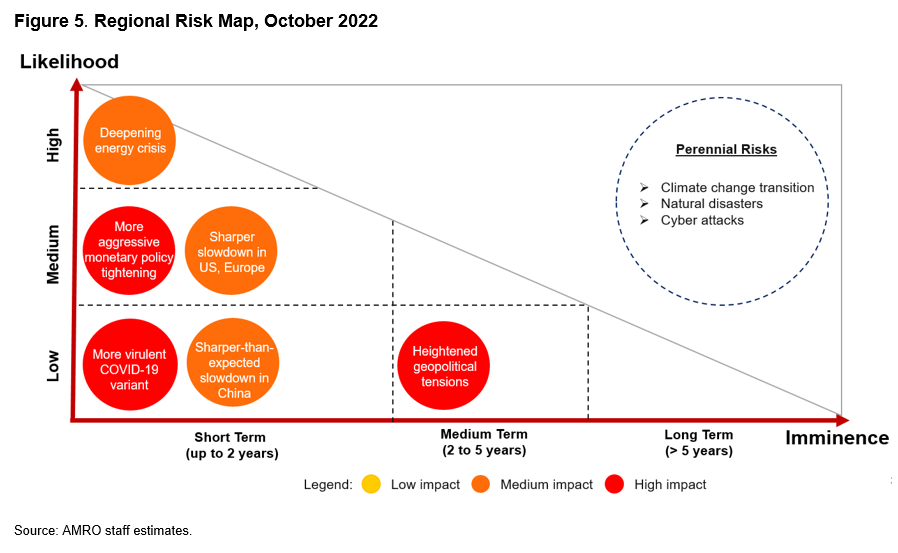

5. Downside risks abound. Our baseline forecasts are subject to various downside risks, including sharper-than-expected slowdowns in key trading partners—including China—as well as more aggressive monetary tightening in the United States. A deeper global energy crisis that could send oil prices skyrocketing once again cannot be ruled out (Figure 5). Heightened geopolitical tensions, and the emergence of a more virulent COVID-19 variant, continue to be tail risks for the region’s outlook.