SINGAPORE, February 18, 2021 – Amid the COVID-19 pandemic, the economy of Indonesia remains resilient. A prompt recalibration of the policy mix and the enactment of large stimulus measures have provided timely support to affected households, businesses, and the financial sector, as well as safeguarded macroeconomic and financial stability. This is according to the 2020 Annual Consultation Report on Indonesia published by the ASEAN+3 Macroeconomic Research Office (AMRO) today. The report was produced based on AMRO’s virtual 2020 Annual Consultation Visit to Indonesia and data and information available up to December 31, 2020.

Recent developments

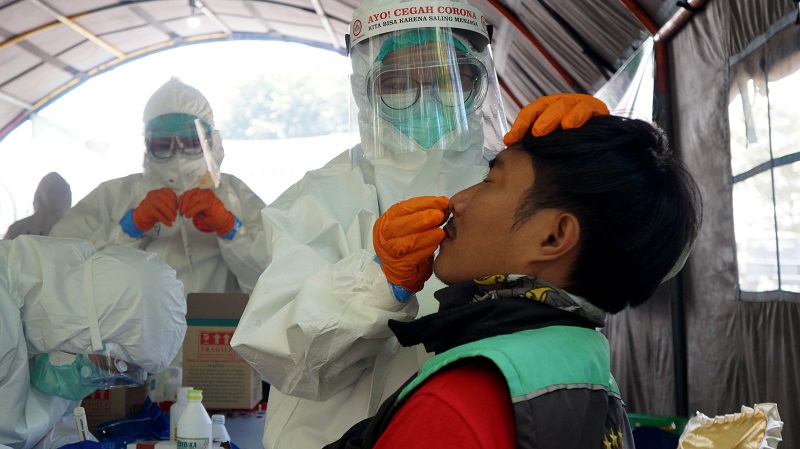

Economic activity has gradually turned around from a sharp contraction triggered by the imposition of large-scale social restrictions in the second quarter of 2020. For the whole of 2020, the Indonesian economy is expected to contract by 2.1 percent, which is modest relative to regional peers.[1] Continued supportive policy synergy, together with the widespread availability of COVID-19 vaccines, is expected to underpin a rebound in growth to 4.9 percent in 2021.

An improvement in the current account balance and resumption in capital inflows have buttressed the external position and supported the rupiah. While imports have remained weak against the backdrop of muted domestic demand, exports have picked up on the global economic rebound and a recovery in commodity prices. Improved investor sentiments and rebalancing of global portfolios have sustained inflows into the government bond market in recent months, supporting the external position.

Strong capital buffers supported by regulatory forbearance, meanwhile, have underpinned overall banking system resilience, although the economic downturn has affected banks’ asset quality to some extent. To assist businesses hit by the pandemic, including micro, small and medium-sized enterprises, loan quality assessment and restructuring criteria were relaxed to allow and facilitate banks to maintain their lending to the business sector.

Extraordinary policy responses

Bank Indonesia (BI) has actively recalibrated its policy mix to maintain stability and support recovery. The measures include providing substantial liquidity support through quantitative easing and conducting triple interventions in the spot FX, domestic non-deliverable forward, and secondary government bond markets, to provide cushions against volatility shocks while maintaining rupiah flexibility. In light of subdued inflation, BI has lowered its benchmark rate, the seven-day reverse repo rate, by 125 basis points, to 3.75 percent as of end-2020. Macroprudential measures have been also eased to stimulate financing to priority sectors while maintaining financial system resilience to support national economic recovery. The total amount of liquidity injected into the money market and banking system, notably through lowering the statutory reserve requirements, term repos, FX swaps, as well as purchase of government bonds in the secondary market, is estimated at about IDR727 trillion, or 4.7 percent of GDP, as of end-2020. BI has also accelerated the implementation of the 2025 Payment System Blueprint initiatives to facilitate economic and financial digitalization.

Sizeable fiscal packages have been rolled out to support affected households and businesses. The 2020 revised Budget introduced fiscal packages totaling IDR695 trillion, or about 4.4 percent of GDP, to cover COVID-19 healthcare spending, social assistance to affected households, sectoral and regional aids (known as the public goods package), and support to businesses, including both MSMEs and bigger firms (non-public goods package). As of end December, about 84.3 percent of the packages was disbursed. Fiscal stimulus packages have been also approved for the 2021 Budget to ensure continued support to the healthcare sector, affected households, and communities, and strengthen structural reforms for a sustainable recovery.

A forward-looking regulation, Perppu 1/2020 (converted into Law 2/2020), was issued to suspend the fiscal deficit ceiling of 3 percent of GDP between 2020 and 2022. It also allowed BI to purchase government bonds in the primary market, guided by prudent principles.[2] BI has purchased government bonds through market-based mechanisms in line with a joint decree between the Finance Minister and BI Governor dated April 2020. Under a one-off burden-sharing agreement in July 2020, BI has also agreed to finance the public goods package through private placements and absorb the entire interest cost of this package, as well as share part of the interest cost of the non-public goods package related to corporate support.

Last but not least, the recent passage of an Omnibus Law on Job Creation is a major breakthrough in improving the investment climate and facilitating job creation.

Risks, vulnerabilities, and challenges

With rapid vaccine developments lifting the economic outlook in 2021, downside risks stem mainly from ongoing uncertainties over the pandemic trajectory in the short-term. While the economic recovery is expected to gain further momentum under continued supportive monetary and fiscal policies, the pace of rebound may be weighed down by current elevated infection rates and tightened social restrictions. Against the backdrop of recent progress in vaccine developments, possible delays in inoculation or weaker-than-expected vaccine efficacy could trigger renewed lockdowns in major economies and cast a shadow on global economic prospects, which would in turn affect Indonesia’s exports and growth outlook. On the upside, a swift and effective vaccination program on a large-scale will enable a stronger recovery for Indonesia.

The government’s gross financing needs rose sharply in 2020 and will remain elevated in 2021, due to sizeable fiscal packages to support the economy. An increase in precautionary savings, weaker demand for credit, and BI financing under the burden-sharing scheme, have allowed the higher budget deficit to be financed without pushing up bond yields in 2020. In addition, improved investor sentiments and rebalancing of global portfolios have sustained inflows to the government bond market in recent months. That said, financing pressure may tighten when savings behavior and credit demand normalizes in tandem with the economic recovery.

The pandemic has underscored the importance of rebuilding policy space in the medium term. The implementation of a consistently sound monetary and fiscal policy framework has enabled Indonesia to build up policy space over the years and gain credibility in the markets. However, with the implementation of large fiscal packages in 2020 and 2021, the policy space is estimated to have shrunk against the backdrop of rising debt levels. This could be further aggravated by a decline in tax revenue due to a planned reduction in the corporate income tax rate.

Future policy considerations

Effective implementation of the current stimulus policy mix on both monetary and fiscal fronts is expected to support economic recovery in 2021. Policy synergy is aimed at achieving a smooth exit from the stimulus measures. The phasing out of BI’s exceptional budget financing should be done in conjunction with the implementation of a credible fiscal consolidation plan. In this regard, the government’s commitment to restore the fiscal rule from 2023 onwards will help to anchor market confidence. The authorities should consider consolidating the fiscal position through raising tax revenue and enhancing spending efficiency. The pace and timing of Indonesia’s exit from extraordinary stimulus measures should also be calibrated within the broader context of policy developments in advanced economies, in particular the U.S.

In the longer run, efforts on financial deepening, in particular, broadening the domestic investor base, will enhance the resilience of the bond market against capital flow volatility shocks. In addition, recent initiatives such as the Blueprint for Money Market Development 2025 that aim to build a conducive ecosystem for foreign exchange and money markets, are expected to accelerate financial market developments in the years ahead. Continued reforms in the areas of economic diversification, investment climate, infrastructure and human capital development, and digital economy, would also enhance Indonesia’s resilience against future shocks.

[1] According to the Statistics Indonesia data released on February 5, 2021, real GDP contracted 2.1 percent in 2020.

[2] In particular, the bonds held by BI should be tradable and marketable, purchased at market rates, with the amount not pre-set and guided by well-defined last resort criteria, taking into consideration the impact on inflation.

—

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, which includes 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support the implementation of the regional financial arrangement, the Chiang Mai Initiative Multilateralisation (CMIM), and provide technical assistance to the members.

About AMRO’s Annual Consultation Report

The Annual Consultation Report was prepared in fulfillment of AMRO’s mandate. AMRO is committed to monitoring, analyzing and reporting to its members on their macroeconomic status and financial soundness. It also helps identify relevant risks and vulnerabilities, and assists members, if requested, in the timely formulation of policy recommendations to mitigate such risks.