By Wei Sun

This article was published in the Asia Times Financial on September 12, 2020.

For many investors, the market turmoil triggered by the COVID pandemic in March was one of the worst in their lifetime. A crash in the US stock market, a sharp plunge in US Treasuries, and a massive selloff across the globe had played havoc with market confidence. The global financial markets only started to stabilize after major central banks, including the Bank of Japan, led global efforts in unveiling their asset purchase programs and lending facilities of unprecedented scale. Like many other investors, portfolio managers of the Japanese life insurers were left with a bittersweet moment.

Encouraged by the market rebounding, Japanese lifers became optimistic to recover some of the losses on their foreign securities investments for the fiscal year.

They will soon have to worry again, as they seek to devise a longer-term strategy for the USD 3.6 trillion assets and the USD 910 billion currently invested overseas.

Challenges are here to stay

Before the COVID-19 pandemic struck, a prolonged low-interest-rate environment had posed many challenges to the Japanese life insurance industry. With the pandemic, these challenges can now be expected to stay for even longer. The interest margin of the lifers contributed little to their profits. The fall in market interest rates domestically over the years has failed to meet the guaranteed returns offered by the majority of the policies, and in the case of legacy contracts, higher returns.

Weakening solvency is another consequence. As lifers have longer-term liabilities than assets, falling interest rates boost the market value of the former more than the latter, which ultimately impairs the lifers’ capital strength.

In AMRO’s 2019 Annual Consultation Report on Japan, a stress test on a hypothetical balance sheet shows that the capital position of the sector could shrink from 5 percent to 2.82 and 0.55 percent if the prevailing market interest rates fall from 1.5 to 0.5 and -0.5, respectively.

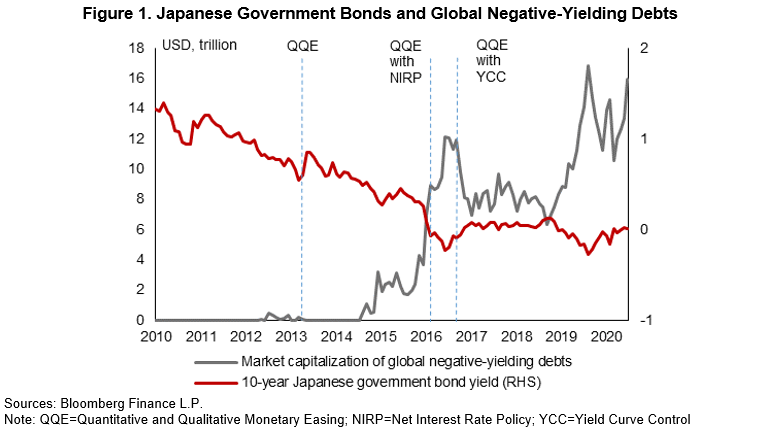

The ultralow policy rates and the liquidity provision globally had kept yields low for market securities in Japan (Figure 1). Even more so in the future with global negative-yielding debts approaching record high yet again, the Japanese lifers will have little choice but to purchase riskier assets and continue their investment exodus more boldly to seek profits (Figure 2).

Made with Visme

The challenge is that finding positive-yielding securities after hedging expenses will not be an easy task in the “lower-for-much-longer” environment.

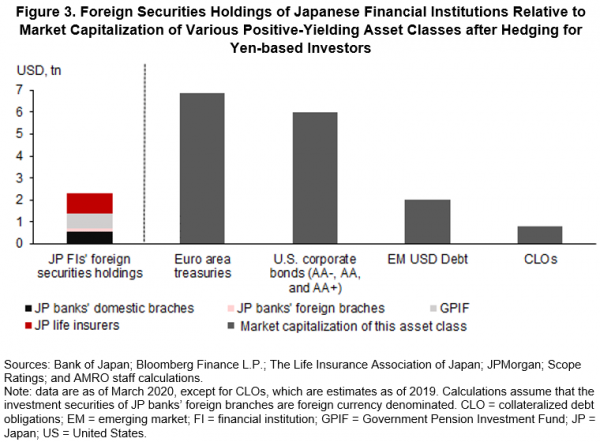

Euro area treasuries, US corporate bonds, emerging market bonds, and collateralized loan obligations are among the few popular options. Unfortunately, Japanese lifers have to face fierce competition from wealthy investors and other financial institutions, for example hedge funds, which are also yield-hungry and can move faster (Figure 3).

As a result, Japanese insurers will have to be constantly on the lookout for new and profitable investment opportunities and possibly venture into even riskier or more unfamiliar investment territories, while reducing hedging positions.

To do that, they need strategies to cope with the increasing complexities of credit, liquidity, and market risks.

Digitalization the way forward in distribution

Nonetheless, the COVID pandemic may prove to be an opportunity for the Japanese life insurers to innovate their businesses.

With over 70 percent of their products sold through agents and sales representatives, the lifers should revamp their distribution channels by deploying more digital solutions in view of observing social distancing measures. Moving businesses online could help reduce operational costs and boost profitability.

The future of Japanese life insurers depends on how they forge strategies under the post-COVID reality. This time, the inherently conservative and prudent sector may be poised to change its traditional way of doing business and become a pioneer in deploying state-of-the-art technologies to manage its costs.

Such changes are spreading into the trading area. As remote as it once seemed, some portfolio managers are already placing their bets from their suburban homes other than Tokyo offices.