AREO 2020 Livestream: Dr Hoe Kee Khor, AMRO Chief Economist (left) and Steve Dawson, Host (right).

SINGAPORE, April 7, 2020 – The ASEAN+3 Macroeconomic Research Office (AMRO) today released its annual flagship report, the ASEAN+3 Regional Economic Outlook (AREO 2020), and hosted a virtual conference to present and discuss its key findings.

The first chapter of AREO 2020 covers the short-term risks, vulnerabilities, and challenges facing the ASEAN+3 economies and the policy options available to them. Chapter two takes a longer-term perspective on growth in the region.

“2019 was a highly eventful year, marked by the escalating US-China trade tensions, geopolitical conflicts, domestic political unrest, market sell-offs, and extreme weather conditions,” said Dr. Hoe Ee Khor, AMRO’s Chief Economist. “Just as we were closing the 2019 chapter on a brighter note with the conclusion of the US-China Phase One trade negotiations, geopolitical tensions in the Middle East flared up, driving up oil prices. No sooner had this subsided, the ‘black swan’ COVID-19 virus broke out in China and turned into a global pandemic.”

Chapter 1: Regional Outlook

The rapidly evolving economic and financial market fallout from the fast-spreading pandemic has resulted in the need to constantly reassess the outlook. AMRO is providing revised forecasts as a supplement to the AREO 2020 report.

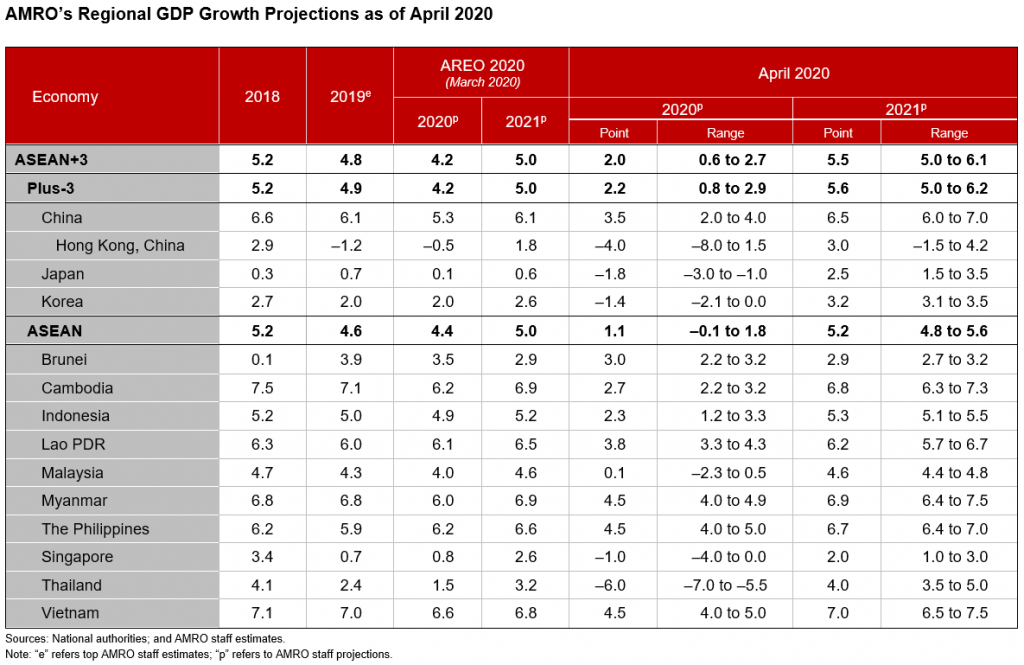

AMRO now projects the ASEAN+3 region’s growth to decline sharply to 2 percent in 2020, followed by a strong rebound to 5.5 percent in 2021. Europe and the United States are expected to go into recession just as the outbreak subsides in China and Korea. As a result, China’s economic recovery will be much weaker at 3.5 percent in 2020.

The ASEAN countries are experiencing a surge in the COVID-19 infection and governments have taken very strict measures—including national lockdowns—to contain the outbreak, and adopted large stimulus packages to support their economies. Nonetheless, the ASEAN economies are expected to weaken sharply and grow at an average of 1.1 percent in 2020, before recovering to 5.2 percent in 2021.

“Although in its fourth edition, the preparation of this chapter has been an almost impossible task this year. We have revised our growth projections significantly downward within three weeks of the data cut-off date on March 16 as new—and sometimes startling—information emerges,” said Dr. Khor. Although the issues and trends covered in the report remain germane, AMRO anticipates that the COVID-19 pandemic will become the unravelling thread that ties several (formerly) tail risks together.

Chapter 2: Sustaining growth in the region

Amid the bleak outlook, structural transformations are now more important than ever for the region to regain its former dynamism and to sustain rapid growth.

In Chapter two, AMRO examines four major trends: (1) the Fourth Industrial Revolution; (2) the increasing protectionist environment in Europe and the United States; (3) the rise of “Factory Asia” and “Shopper Asia”; and (4) growing regional integration.

The transition to the technology- and services-driven new economy calls for new growth approaches, a “technopreneurial” spirit, and closer regional collaboration. While regional economies can continue to leverage on the conventional manufacturing-for-export strategy to advance up the technological ladder and become more competitive, it is equally important to develop the services sector in tandem, to boost competitiveness, innovation, and growth and employment.

The rise of “Factory Asia” has entrenched the region’s competitiveness in a wide range of manufacturing activities. More importantly, the sharp increase in household income has led to the rise of “Shopper Asia.” The region has become a strong source of final demand for both goods and services, characterized by an expanding middle-class with greater spending power. This development provides the region with a strong base to continue embracing the global production network and global marketplace.

To position the region strongly, policymakers need to broaden and quicken their efforts in developing human capital, facilitating freer cross-border flow of skilled labor and professionals, and updating rules governing trade. A fresh interpretation of “social safety net” is also necessary, particularly in view of the growing importance of the gig economy. It is crucial for regional governments to put in place stronger social safety nets in conjunction with efforts to enhance the regional financial safety net.

“The global tragedy of the COVID-19 pandemic reminds us of our collective destiny and challenges the region to demonstrate its resilience and commitment to come up with solutions that safeguard and strengthen our long-term interests. The capacity to rise to the challenge is not in doubt, and the will to shape our future together is strong,” Dr. Khor concluded.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, which includes 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support the implementation of the regional financial arrangement, the Chiang Mai Initiative Multilateralisation (CMIM), and provide technical assistance to the members.

About the AREO report

Launched in 2017, the 20th anniversary of the Asian Financial Crisis, the AREO provides AMRO staff’s assessment of both the conjunctural and structural issues facing the ASEAN+3 region.

The AREO 2020 is based on information available as of March 16, 2020. It was prepared prior to the publication of much of members’ macroeconomic data for February 2020, when the impact of the COVID-19 epidemic was starting to manifest. Therefore, it does not include substantial informed analysis on the impact of what has become a global pandemic, nor many of the related policy responses that were subsequently announced by member authorities. The COVID-19 pandemic has significantly increased the uncertainty and downside risks around the global and regional outlook, and AMRO staff will continue to update their analyses and projections in the months ahead, taking into account new data releases and policy responses.