Global markets have been buffeted this year by rising US policy uncertainty, fiscal strains, and heightening geopolitical tensions. The April 2 announcement of broad-based tariffs–dubbed “Liberation Day”–sparked sharp volatility across global markets, underscoring fragile investor sentiment. While the full impact of these tariffs is yet to unfold, global financial conditions tightened markedly in April, before easing somewhat following a 90-day tariff pause. Most recently, global financial markets were shaken again following the US announcement of additional tariffs on China on October 10.

The uncertainty over US trade and fiscal policies have also dented confidence in the US dollar’s traditional safe haven status. Despite rebounds in the US equity markets and Treasury yields following the 90-day tariff pause on April 9, the dollar’s slide since February has continued. The once-tight link between US Treasury yields and the dollar now appears to have weakened.

For ASEAN+3, US trade policy shocks have triggered temporary market stress, but these effects have generally stabilized after the initial shock. Most regional currencies have strengthened against the US dollar since the beginning of the year, while government bond yields—which have become less sensitive to US yields—have fallen in most regional economies. The extent of spillovers has varied, depending on each country’s economic and market structures as well as the degree of trade exposure to the US and the effective tariff rates faced.

Holding firm against global spillovers

Despite global market turbulence and trade tensions, ASEAN+3 economies and financial markets remain resilient. The region is projected to grow at 4.1 percent in 2025, moderating slightly from 4.3 percent in 2024. According to AMRO’s findings, growth continues to be close to potential, supported by strong domestic demand and better-than-expected exports, in part due to front-loading activities in the first half of the year. As the full impact of tariffs filters through, regional growth is expected to slow to 3.8 percent in 2026. Compared to AMRO’s July 2025 projection, growth outlook was revised upward in nine out of 14 economies, including plus three economies (China, Japan and Korea) and large ASEAN countries.

Inflation has stayed low, despite a temporary spike in global commodity prices triggered by the Middle East tensions in June. With energy and food prices easing and demand pressure subdued, inflation is likely to remain contained.

Strong fundamentals and swift policy actions have anchored the region’s economic and financial resilience. Banking systems remain sound and well-capitalized, while relatively ample foreign exchange reserves provide buffers against external shocks. As inflationary pressures remain low, many central banks have shifted toward accommodative stance to support growth while deploying other policy tools, such as foreign exchange intervention, to stabilize financial markets. Fiscal measures—from targeted subsidies to government spending—have further cushioned domestic demand.

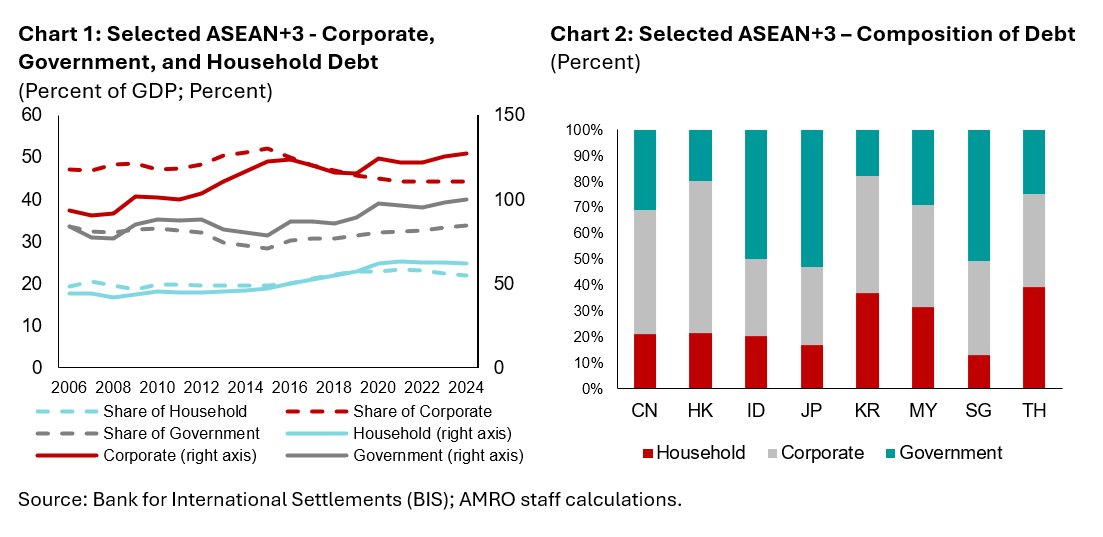

Nonetheless, pockets of vulnerabilities remain. Total debt-to-GDP ratios have edged up, driven by both corporate and government borrowing (Chart 1), while the composition of debt varies across countries (Chart 2). Small-and medium-sized enterprises (SMEs), in particular, are more vulnerable. The US tariffs, as they come into effect, will likely pose further pressure on export-oriented industries. Elevated sovereign debt and higher interest burden in some economies also raise concerns over debt sustainability.

Policy recommendations for the way forward

External risks will continue to pose significant challenges. US policy uncertainty remains a major source of risk for ASEAN+3 and the global economy. The impact of tariffs will vary depending on firms’ exposure—directly or indirectly—to US demand, as well as their pricing power in the US market. Existing vulnerabilities, especially among SMEs with US exposure, warrant close monitoring.

Questions over the dollar’s safe-haven status may heighten market volatility, as the absence of a comparable alternative risks fragmenting the global financial system. As US dollar-denominated assets constitute around 50 percent of global equities and 40 percent of global bonds, a disorderly shift toward a basket of currencies would raise liquidity management costs. Furthermore, capital flows redirected into regional economies could potentially fuel credit booms and asset price misalignments.

Geopolitical tensions elsewhere—if they intensify—could spark another surge in oil prices and shipping costs, fanning supply-side inflation and compounding the drag from trade restrictions.

To sustain resilience in the near term, ASEAN+3 policymakers must remain vigilant and agile. A carefully calibrated policy mix is crucial: monetary policy to counter broad economic slowdowns, targeted fiscal support for vulnerable sectors, and macroprudential tools to preserve financial stability. Striking a good balance between supporting growth and preserving policy space will be key.

A call to collective resilience

Above all, collective action will be vital. Deepening regional trade and financial integration can help ASEAN+3 absorb global shocks more effectively over the medium term, while laying the groundwork for longer-term competitiveness. Stronger policy coordination and regional safety nets will also bolster confidence in the region’s ability to navigate external challenges.

The global headwinds are unlikely to fade soon. But ASEAN+3 has already shown that strong fundamentals and sound policies can keep growth on track even in unsettled times. By working together to reinforce resilience, the region can not only weather today’s turbulence but also accelerate its transition toward a more sustainable, innovative, and inclusive growth model for decades to come.