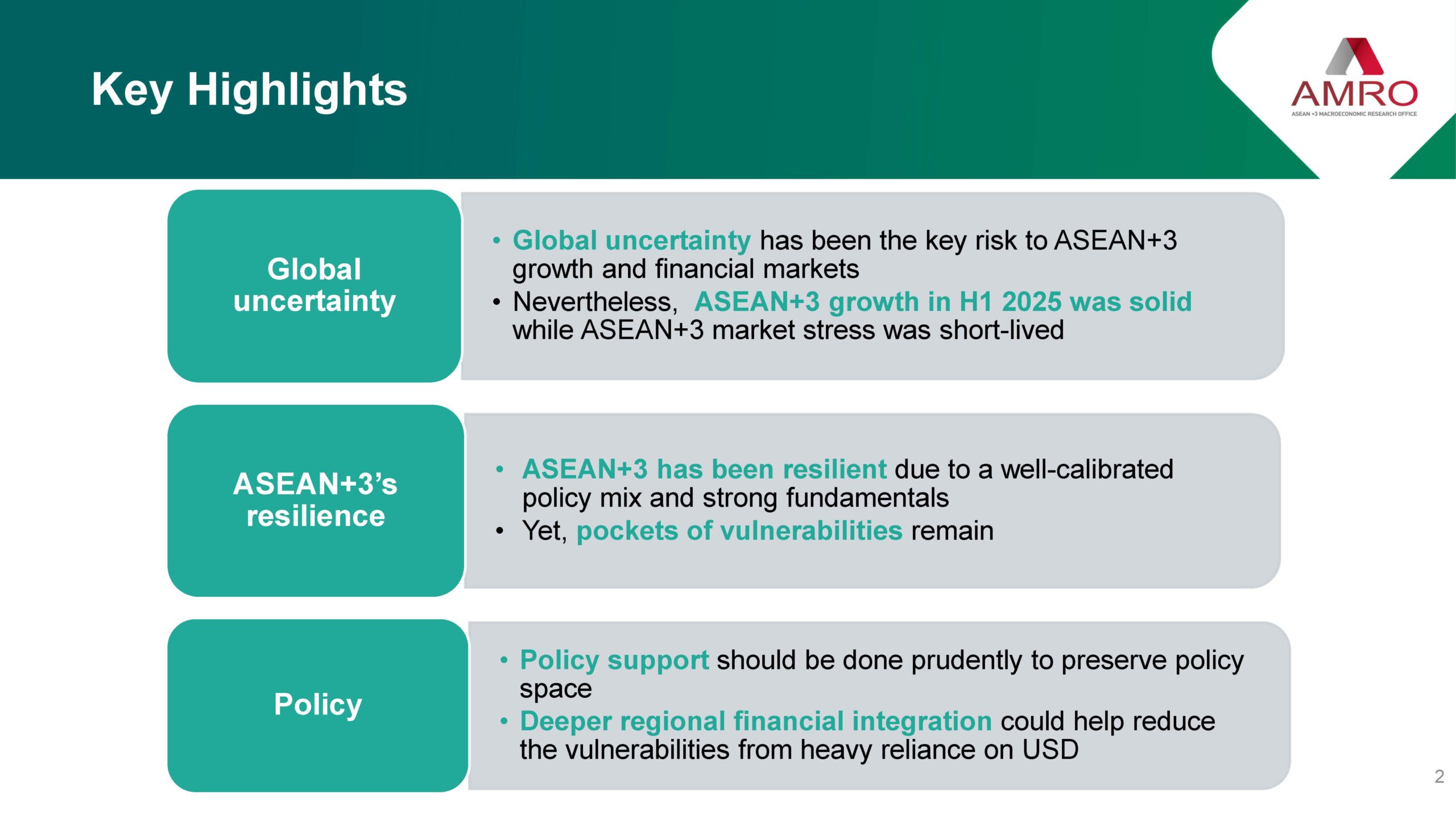

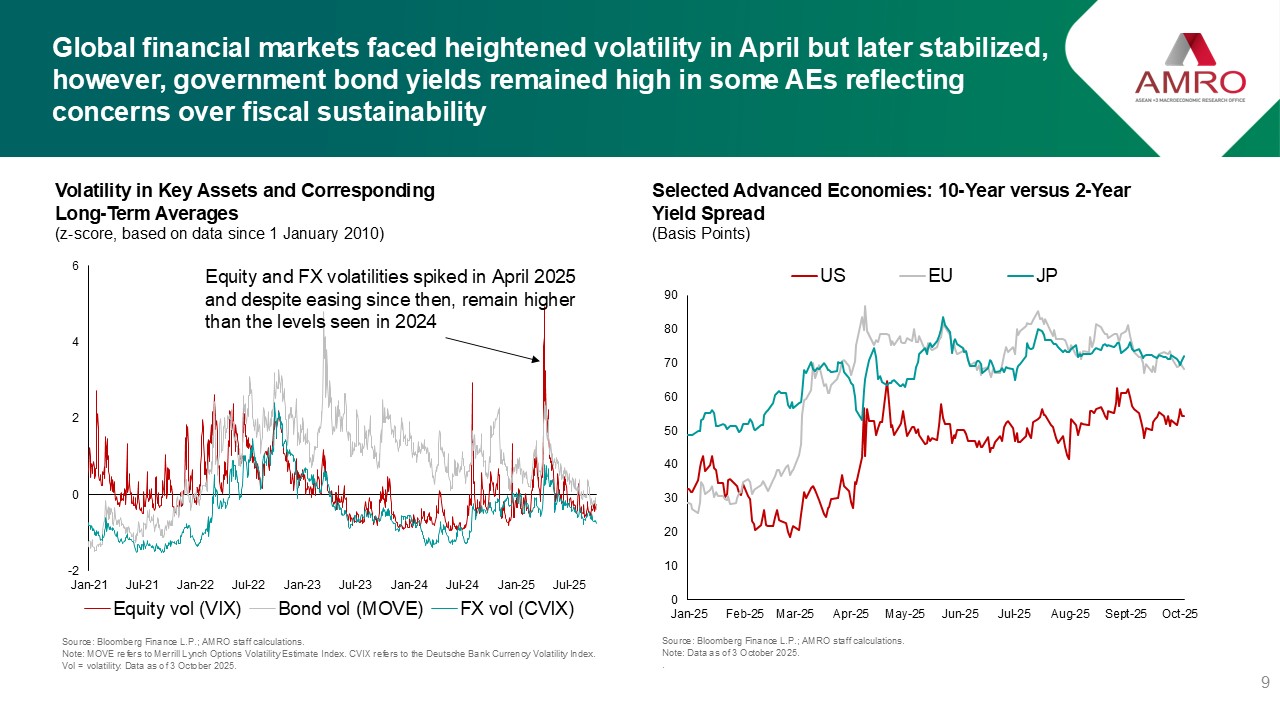

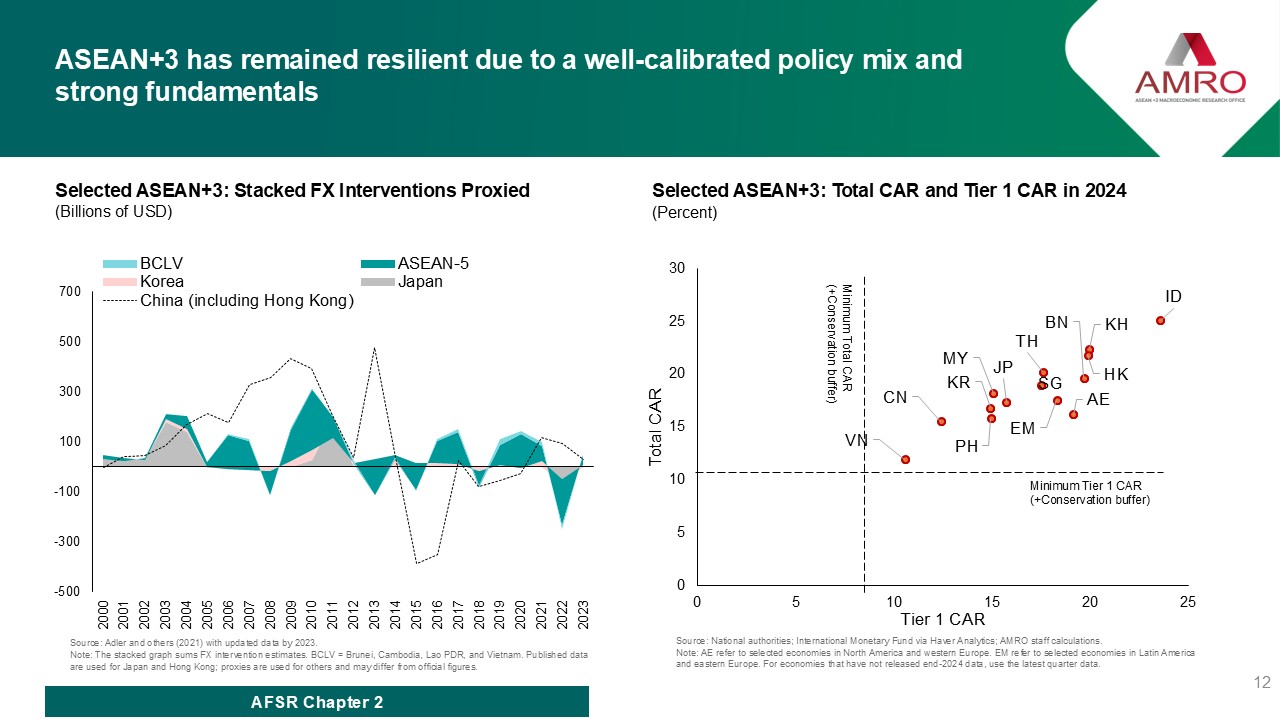

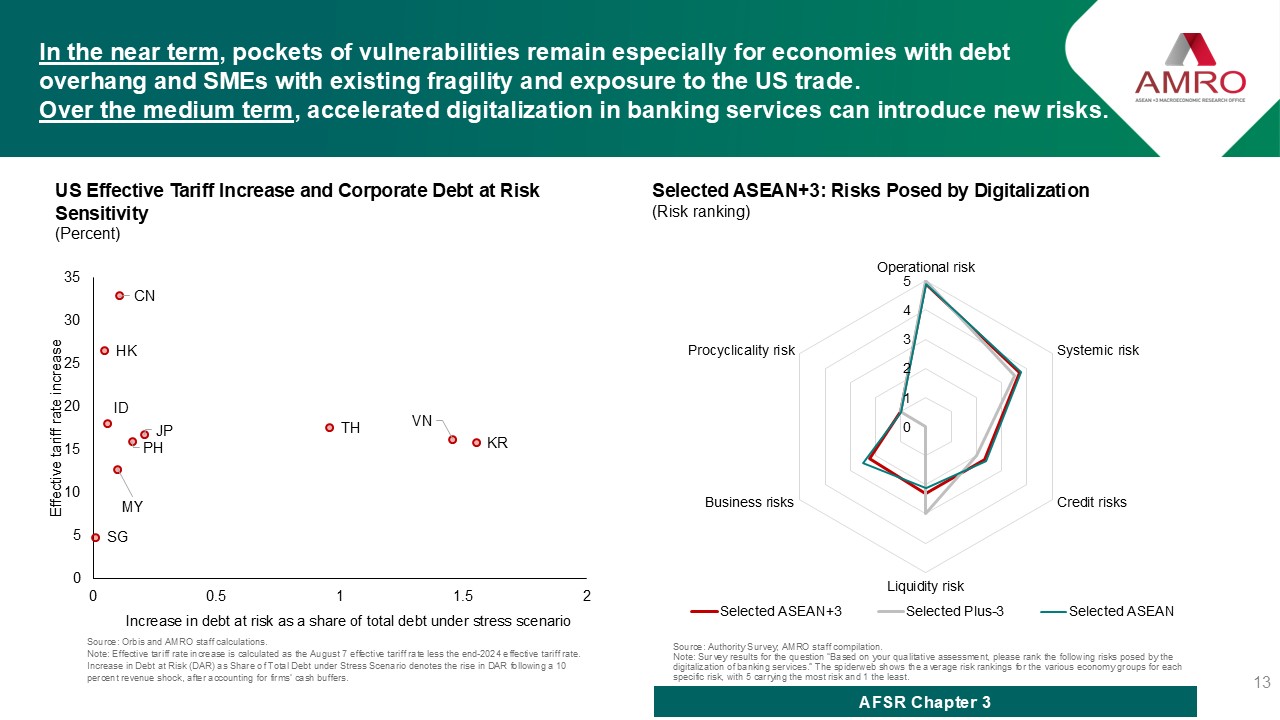

Global financial markets face heightened volatility from US policy uncertainty, fiscal sustainability concerns over major economies and geopolitical tensions. These developments pose direct challenges to ASEAN+3 economies, which are deeply integrated with the global financial environment, testing the region’s resilience. Beyond immediate challenges, rapid digitalization of financial services could also introduce new vulnerabilities.

This year’s report features three chapters: Chapter 1 reviews recent market developments and external uncertainties; Chapter 2 examines spillovers from global monetary policy shocks and ASEAN+3 policy responses; and Chapter 3 explores the financial stability implications of the digital transformation in the banking sector.