China’s foreign direct investment (FDI) inflows have significantly declined since 2022, raising concerns about potential capital outflows. However, a recent study by AMRO indicates that this decline in actual FDI utilization is mainly concentrated in traditional sectors, while high-tech industries have experienced significant growth in recent years.

The automotive industry exemplifies these structural transitions driven by the strategic reallocation of FDI within China. As one of the country’s pillar industries, the auto sector has contributed approximately 10 percent to China’s overall economic output in recent years.

Evolution of China’s auto industry

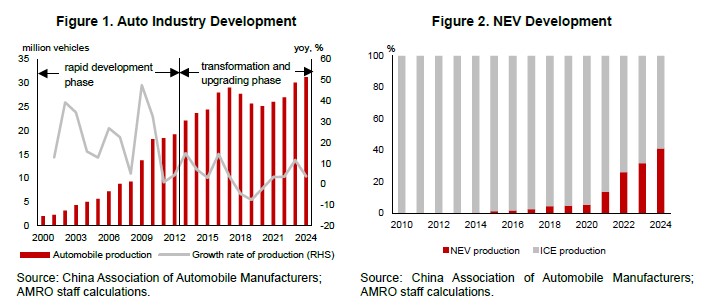

The development of China’s auto industry has undergone four major stages (Figure 1): startup phase (1953-1978), growth phase post-opening up (1979-2000), rapid development phase after World Trade Organization accession (2001-2010), and transformation and upgrading phase driven by new energy vehicles (NEV) (2011-present).

In 2009, China overtook the United States to become the world’s largest automotive market. Starting in 2011, the Chinese government capitalized on emerging opportunities, ramping up policy support, increasing investments, and actively promoting the development of NEVs. By 2024, NEV production accounted for over 40 percent of China’s automotive market (Figure 2).

This rapid growth not only generated a significant number of direct jobs but also catalyzed the development of related industries through an extensive upstream and downstream supply chain.

FDI lays groundwork for modern development

Over the past few decades, foreign investment has played a pivotal role in fostering the growth of China’s auto industry. In 1984, Volkswagen established the first joint venture in Shanghai to manufacture passenger cars in China, marking a major milestone in the country’s automotive history and international cooperation.

Traditionally, joint ventures aimed to reduce production costs and enhance market competitiveness by manufacturing foreign car models in China for exports. However, over time, especially after 2004, most of the joint ventures in China are aimed at capturing the rapidly growing Chinese market. Over the following decade, FDI in the auto industry accounted for an average of about 25 percent of total investment in the sector. By 2016, foreign and joint venture brands dominated the market—more than 30 joint venture car brands accounted for approximately half of China’s total sales volume.

These partnerships enabled Chinese automakers to establish a comprehensive framework encompassing product development, manufacturing technologies, value chain management, dealership networks, brand maintenance, and employee management, paving the way for a modern, globally competitive auto industry.

More interdependent partnership with foreign investors

In recent years, the relationship between foreign investors and Chinese automakers has evolved from straight-forward collaboration to more integrated and interdependent partnerships that foster mutual growth and innovation. While sales of joint venture brands have declined with the rise of NEVs and competitive domestic brands, many foreign automakers are increasingly leveraging China’s advantages in NEV supply chains and innovation.

For example, Volkswagen’s investment of RMB 10 billion in an R&D center in Hefei, where a comprehensive NEV supply chain is well established, and an additional RMB 5 billion in local NEV manufacturer Xiaopeng, highlights this trend. These investments aim to jointly develop pure NEV models, demonstrating a long-term commitment to the Chinese market despite an evolving market landscape.

Beyond serving the growing domestic market, foreign automakers are also utilizing their production capacity in China to supply global markets. BMW, for instance, exports vehicles produced in China to other markets in Asia, integrating Chinese manufacturing into global supply chains.

Opportunities and challenges ahead

Despite setbacks from the COVID-19 pandemic and rising geopolitical tensions, China’s vehicle exports have experienced robust growth in recent years. Since 2023, China has become the world’s largest auto exporter for two consecutive years—testament to the quality and competitiveness of China-manufactured vehicles.

However, the road ahead is not without obstacles. Rising geoeconomic fragmentation has introduced greater uncertainty. High import tariffs in the US and other major economies threaten to erode the competitiveness of cars made in China. As a result, automakers may need to optimize global supply chains and expand production capacities overseas to strengthen competitiveness in the international markets.

That said, shifting geopolitical dynamics have also created new opportunities. For instance, Russia has climbed from being China’s eighth-largest auto export destination in 2022 to its top market over the past two years. This shift demonstrates the sector’s adaptability in navigating complex international trade environments.

Despite an evolving global landscape, China’s auto industry remains resilient and well-positioned to maintain its leadership. Through continued innovation, strategic foreign partnerships, and adaptive business models, it is poised to respond to both domestic and international market conditions.