The ASEAN+3 region is set to remain resilient with a steady growth rate of 4.2 percent in 2025, according to the January Update of the ASEAN+3 Regional Economic Outlook (AREO). This expansion is driven by domestic demand—private consumption across most ASEAN+3 economies remains robust, supported by favorable employment conditions and easing inflation. At the same time, improving external demand, particularly in the technology sector, will continue to lift growth.

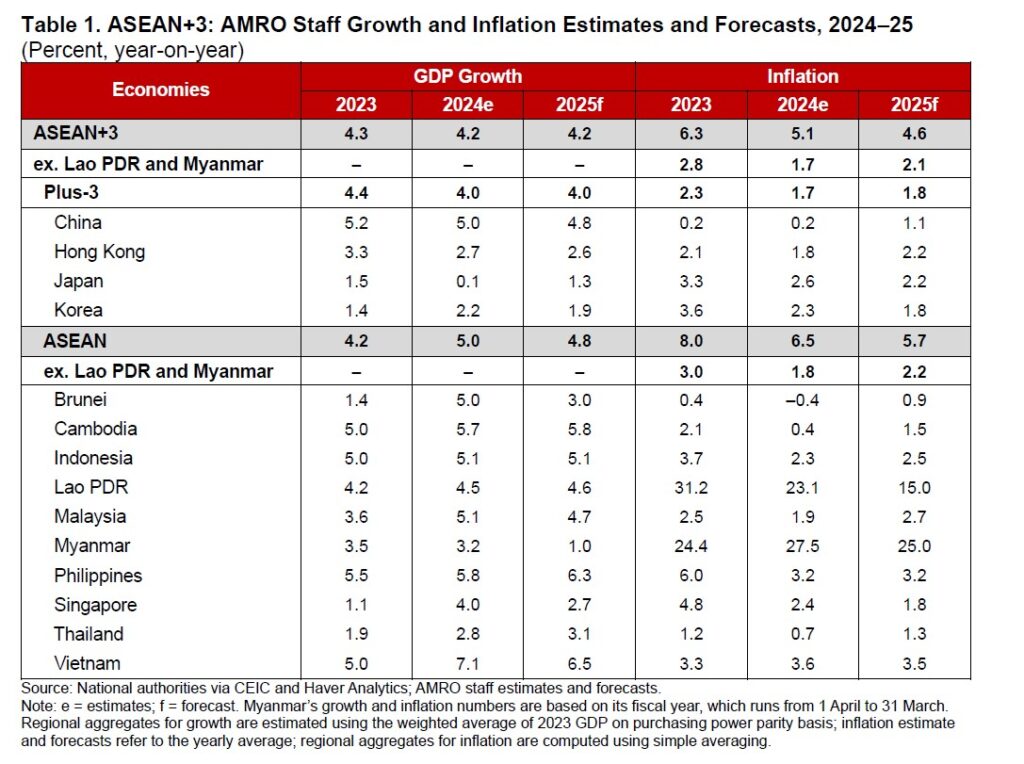

Meanwhile, inflation for the region, excluding Lao PDR and Myanmar, is projected to remain low at 2.1 percent in 2025, a slight uptick from 1.7 percent in 2024 due to improving domestic demand and supply-side adjustments (Table 1).

However, uncertainties to the outlook loom large. Slower growth in the US, Europe, or China could dampen exports, while potential spikes in global commodity prices due to extreme weather or geopolitical tensions could restoke inflation. The most immediate concern, however, is potential policy shifts under the new US administration. As a major trade partner, the US’s policy changes, including import tariffs, fiscal expansion, and immigration reforms, will affect ASEAN+3 economies.

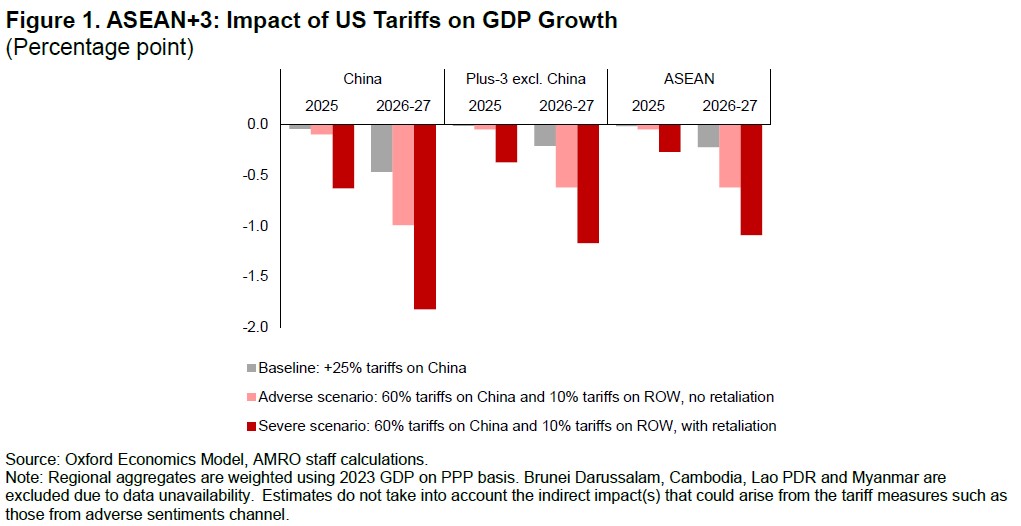

Among the potential shifts, the new administration’s proposed tariffs aimed at reducing the US trade deficit and protecting domestic industries present the most prominent risk. Higher tariffs on key US import sources, such as China, risk reigniting inflationary pressures in the US and dampening domestic demand, which could, in turn, weaken global demand as the US is a major final consumer globally. Retaliatory measures by affected economies would exacerbate global demand weakness. Under a scenario of 60 percent tariff by the US on Chinese imports and 10 percent tariff for all other economies, with in-kind retaliation from affected countries, regional growth could be lower by 1-2 percentage point over the next two years, resulting in the lowest regional growth since the Asian Financial Crisis (Figure 1).

If inflation in the US resurges, monetary policy is likely to be tightened, leading to a stronger dollar and tighter global financial conditions. For ASEAN+3 economies, these dynamics could trigger capital outflows and exchange rate depreciations, and possibly higher policy rates and overall tighter financial conditions that would further weigh on growth.

Despite these challenges, the ASEAN+3 region remains resilient, underpinned by sound fundamentals and robust domestic demand. The region has a strong track record of managing external shocks, including the COVID-19 pandemic, global supply chain disruptions, and ongoing US-China trade tensions. Most economies in the region entered this period of uncertainty with moderate fiscal space and well-anchored inflation expectations, providing room for counter-cyclical policy measures if necessary.

ASEAN+3 economies must prioritize both immediate and long-term strategies to safeguard growth and resilience. In the short term, currency flexibility is essential to absorb the impact of tariffs and partially offset losses in export competitiveness. Governments can also implement measures to support affected industries, such as streamlining customs procedures to reduce delays, providing timely information on tariff impacts, and offering targeted assistance to affected sectors. Regional cooperation will also be critical in mitigating these challenges. While pursuing proactive policy measures, regional economies must also be mindful of spillover risks and avoid policies—such as competitive devaluation—that would result in counterproductive outcomes.

Over the medium to long term, ASEAN+3 economies can diversify export markets by pursuing new trade agreements beyond the US while reducing internal trade barriers and integrating value chains to deepen regional ties. Investments in innovation, technology, and human capital, alongside improvements in physical and digital infrastructure, will further strengthen competitiveness and reduce business costs. For China, advancing domestic consumption-driven growth and technological self-reliance will be vital.

The ASEAN+3 region has consistently showed its resilience in navigating external challenges through sound policies and strong regional cooperation. As a highly open region, it must remain steadfast in its commitment to openness and a rules-based trading system, while engaging in constructive dialogue with the US and fostering multilateral cooperation. This approach is particularly critical as protectionist tendencies are on the rise globally. By capitalizing on its sound fundamentals, strong policy buffers, and enhanced regional collaboration, ASEAN+3 is well-positioned not only to weather uncertainties but also to emerge stronger in an increasingly unpredictable world.