Over the past decade, Cambodia has made progress in integrating into the global trade network and diversifying its exports beyond traditional products such as garments and textiles.

Amid the changing global trade landscape, the country faces challenges such as trade disruptions and intensified competition. It is now critical for Cambodia to identify and build on its strengths to move up the global value chains (GVC).

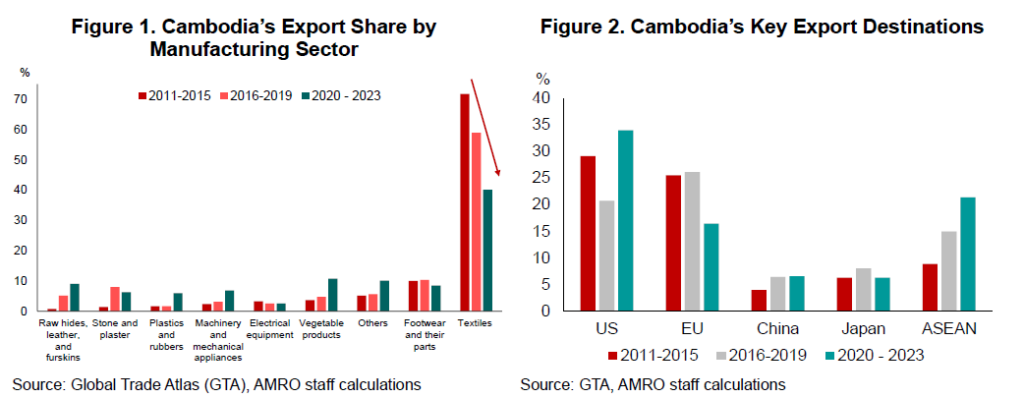

Cambodia’s export profile has undergone transformations in both products and trading partners. Although textiles remain a key export, the sector’s share of total exports has shrunk to 40 percent in 2020-2023 from 70 percent in 2011-2015 (Figure 1). A positive shift toward new export products, such as machinery, plastics and rubber, and vegetable products, has started over the past decade. Cambodia is also expanding and diversifying its markets, from the US, EU, and China to ASEAN (Figure 2).

A closer examination into Cambodia’s current GVC participation reveals both its progress and challenges.

According to AMRO’s 2024 Annual Consultation Report on Cambodia, the country has managed to capture a modest share of domestic value-added (DVA) in its exports, with 65 percent of exports attributed to DVA, primarily in final products.

In agriculture, Cambodia is doing well by producing higher value-added products. However, the manufacturing sector faces bigger challenges due to its heavy reliance on imported parts and materials, which means there is a need to build up domestic manufacturing capabilities and move toward stronger local sourcing.

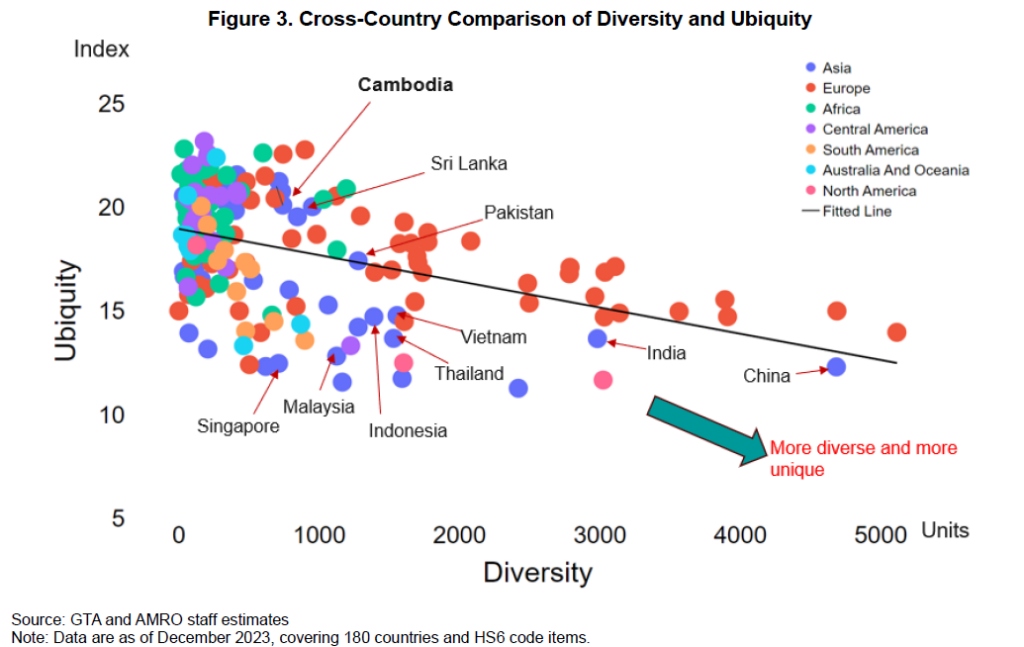

Based on AMRO’s analysis of the diversity and ubiquity metrics, Cambodia’s export mix is less diverse than that of its peers such as Vietnam or Sri Lanka. Moreover, Cambodia tends to produce goods that are also widely made by other countries (Figure 3).

Still, Cambodia has the potential to improve its position in the global trade network and boost its export diversity and ubiquity. The country has already kickstarted the initial stages of structural transformation which is aimed at shifting its manufacturing sector from labor-intensive activities to more diverse and higher value-added products. Its economic activities are gradually reallocated toward sectors beyond textiles and garments.

While Cambodia has several paths to diversify into new products and enhance ubiquity by moving into higher value-added products, the harder part is to determine which sectors to focus on.

When choosing the sectors, Cambodia needs to consider how complex, connected, and promising each industry is. Entering a more advanced manufacturing sector might offer long-term benefits. But it comes with challenges such as learning new technologies. Attracting foreign investment and encouraging technological transfer are important. Furthermore, these efforts must be backed by a clear strategy to ensure Cambodia can effectively use and benefit from these advancements.

Cambodia could consider two broad strategies:

- A balanced strategy, which focuses on sectors where Cambodia already has some strength, such as food processing, garments, and machinery.

- A big jump strategy, which is a more ambitious approach and targets high-tech and complex manufacturing sectors, such as heavy machinery.

In Cambodia’s case, it seems that the “balanced strategy” would be more practical and fitting because it leverages the country’s existing strengths. Furthermore, gradual diversification helps avoid sudden changes and the transition would be smoother and less risky than the “big jump strategy”.

No matter which strategy is chosen, strong government support is needed for its successful implementation. This includes investing in local businesses, developing talent, and creating a welcoming environment for long-term investment. The government must also be mindful of potential risks, such as environmental impacts, over-reliance on foreign investment, and short-term economic changes during the transition.