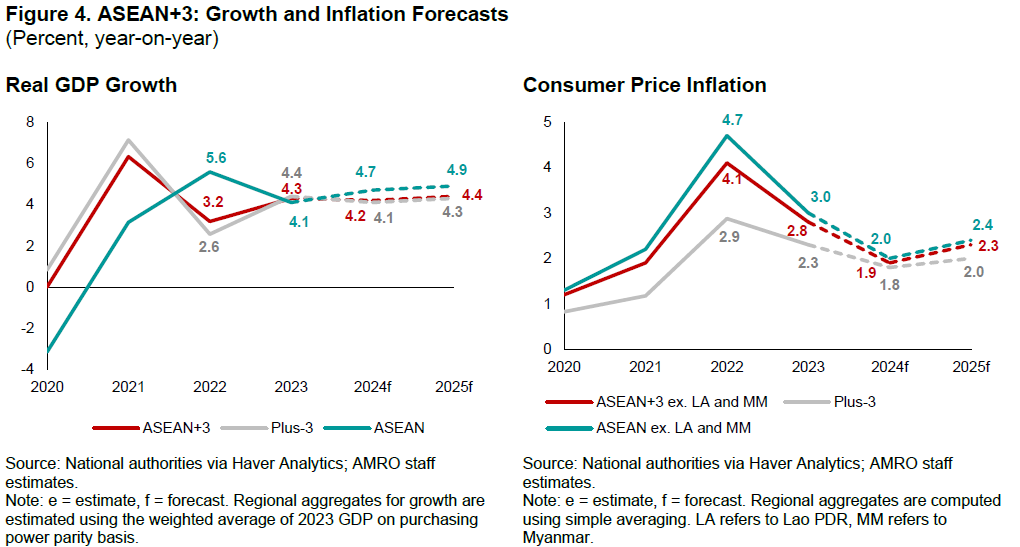

The ASEAN+3 region sustained solid growth in the first half of 2024, with inflation remaining well-contained. However, regional growth is forecast to be slightly lower at 4.2 percent in 2024 due to country-specific factors, but to improve to 4.4 percent in 2025. Continued recovery in external trade and tourism, as well as robust domestic demand, will remain the key drivers of growth.

Inflation for the region—excluding Lao PDR and Myanmar—is expected to ease to 1.9 percent in 2024, a slight downward revision from the July 2024 AREO Update, and to increase to 2.3 percent in 2025. Risks to outlook continue to shift, with large uncertainties ahead, especially relating to the US presidential election and geopolitical developments.

Here are five key takeaways from AMRO’s October 2024 update of the ASEAN+3 Regional Economic Outlook (AREO):

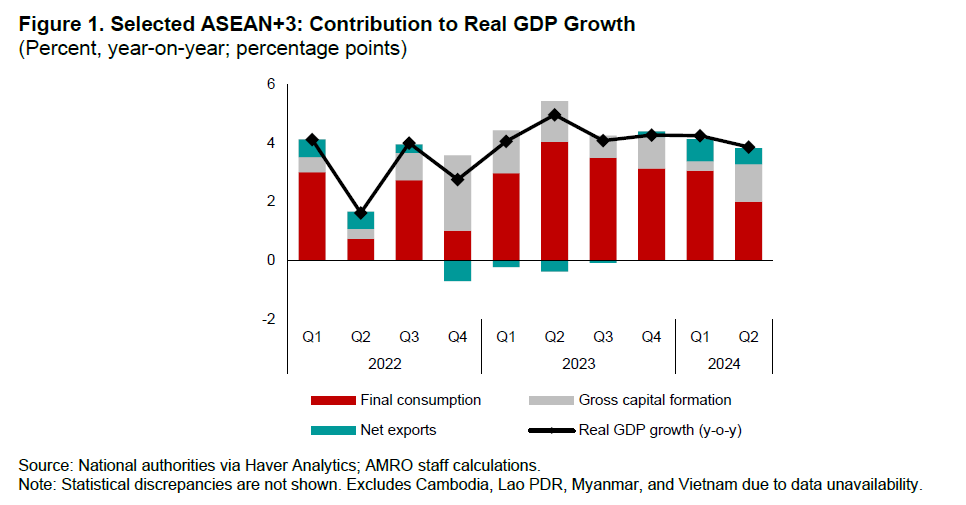

1. Growth in the ASEAN+3 economies remained strong in the first half of 2024, anchored by domestic demand and an upturn in exports. Private consumption in most ASEAN economies remained resilient, supported by favorable employment conditions and easing inflation. Domestic investment for most economies also picked up in the second quarter, alongside improving industrial activities.

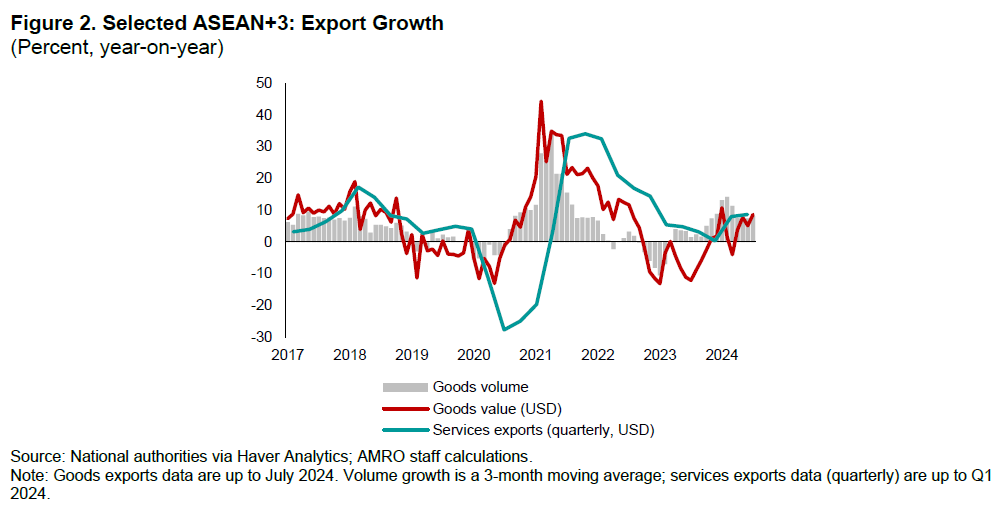

2. The region’s export recovery continued to strengthen in the first half of 2024, supported by an improving global outlook and strong demand for tech products. The second quarter saw higher export values across most regional economies, and August PMI data showed sustained exporter confidence, particularly in the automotive and tech sectors. The upturn in the global semiconductor cycle, fueled by growing demand for AI-related chips, significantly boosted semiconductor exports in the region. Global pick-up in capital expenditure, especially in AI-related technologies and infrastructure, adds further momentum to the region’s export.

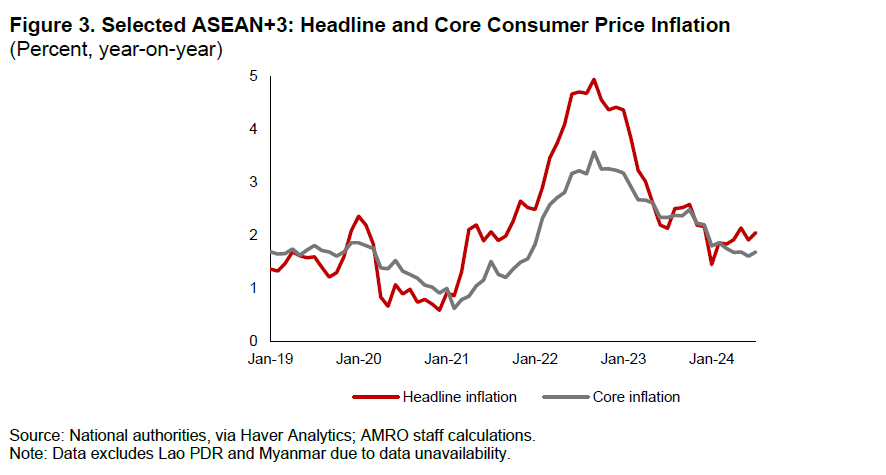

3. Core inflation moderated across most regional economies, while headline inflation’s downward trend was disrupted by supply shocks. Although core inflation continued to ease, headline inflation—which had been steadily declining since 2022—experienced temporary spikes due to surges in global energy and transportation prices. Recently, these shocks have subsided, with energy and freight costs retreating from their peaks. Additionally, stronger regional currencies have helped reduce pressures from imported inflation. Most central banks in the region held their policy rates steady in view of resilient domestic demand, although some have adjusted monetary policy in response to country specific economic conditions.

4. Overall, regional growth is revised slightly lower to 4.2 percent in 2024, but is forecast to improve to 4.4 percent in 2025. The slight adjustment for 2024 reflects downward revisions for China and Vietnam. Nonetheless, Plus-3 economies are still projected to grow robustly at 4.1 percent, while ASEAN is expected to expand by 4.7 percent in 2024, supported by resilient domestic demand and recovering external trade and tourism. In 2025, higher growth is projected in 10 out of 14 economies compared to 2024, aligning with expectations of strengthening domestic and external demand amid easier financial conditions.

Headline inflation in the ASEAN+3 region is expected to ease to 1.9 percent in 2024, reflecting the continuing impact of tight monetary policy, softer food prices, and lower imported inflation. However, inflation is projected to rise slightly to 2.3 percent in 2025, driven by stronger economic growth and supply-side factors.

5. External risks to the region’s outlook have rapidly evolved since the July 2024 AREO Update. Recent US economic indicators, such as labor market weakness and soft PMI figures, have raised concerns about a sharper growth slowdown, which could hurt regional exports. Slower growth in China may also affect regional trade, investment, and tourism. The outcome of the November US presidential election is consequential as it may lead to higher protectionist measures with adverse impact on the region. Additionally, rising geopolitical conflicts could drive up energy and freight costs, hindering export recovery and reigniting inflationary pressures. A sharp rise in financial market volatility, like in early August, remains a risk as markets become more sensitive to economic data and policy shifts.