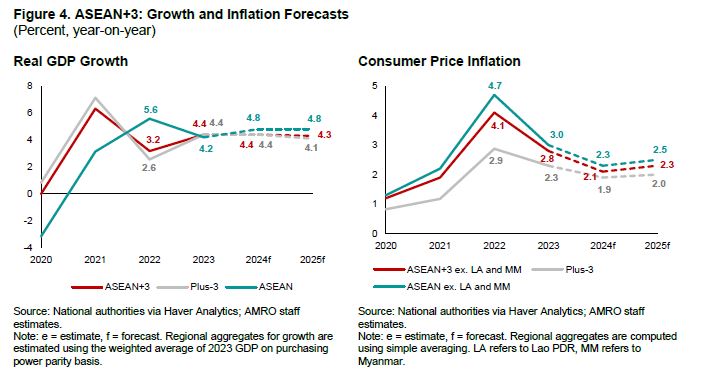

The ASEAN+3 region is forecast to grow at 4.4 percent in 2024 and 4.3 percent in 2025, broadly unchanged from our assessment in April. Favorable export prospects, alongside robust domestic demand and continued recovery in tourism, will support the region’s growth this year and the next. Inflation for the region—excluding Lao PDR and Myanmar—has been revised downwards to 2.1 percent in 2024 and is expected to increase slightly to 2.3 percent in 2025.

Here are five key takeaways from AMRO’s July 2024 update of the ASEAN+3 Regional Economic Outlook (AREO).

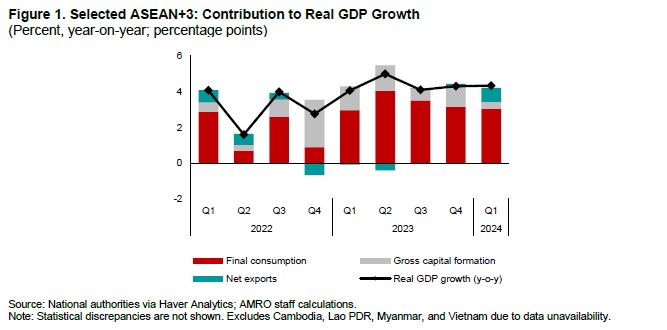

1. Growth momentum continued to strengthen across ASEAN+3, anchored by resilient domestic demand. Strong employment conditions and stable prices sustained private consumption in the region. Retail sales were supported by the recovery in travel and tourism. Improving prospects in key export markets have bolstered business sentiment, but lingering economic uncertainty has tempered investment growth in most economies.

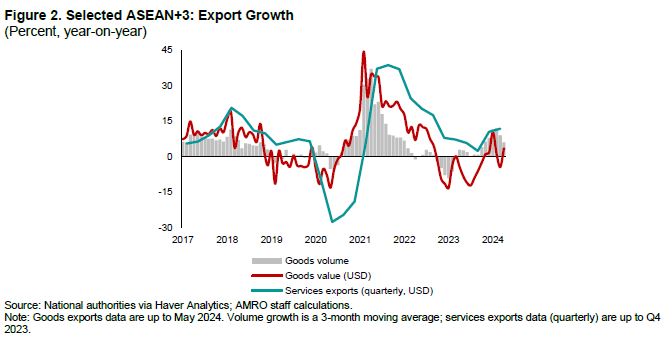

2. Recovery is underway for the region’s goods exports. 12 economies are seeing higher export growth compared to the second half of 2023, buoyed by improving overseas demand and favorable export prices. Despite concerns about shipping disruptions in the Red Sea, export momentum is expected to gain traction as the global economy strengthens. The upturn in global electronics is also benefiting more economies in the region. Travel and tourism are nearing pre-pandemic levels, aided by favorable visa policies and the return of Chinese tourists.

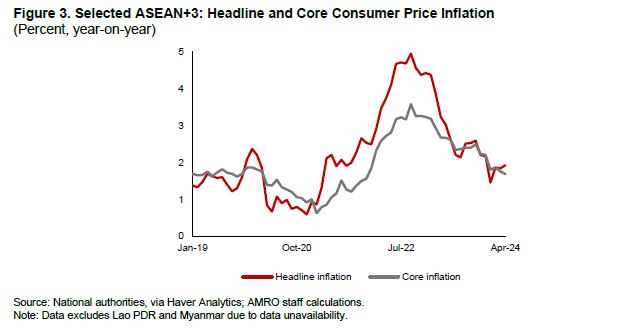

3. Inflation has seen a slight uptick since the April AREO assessment. Rising global energy and transportation prices have halted the broad decline in headline inflation across ASEAN+3. Crude oil prices increased sharply amid escalating conflict in the Middle East and oil production cuts, while shipping disruptions in the Red Sea led to higher freight prices. Nonetheless, inflation in the region remains largely contained, even with strong domestic demand keeping core inflation elevated in some economies.

4. Overall, the ASEAN+3 region is likely to enjoy a steady recovery in the near term. The region is projected to grow at 4.4 percent this year, slightly lower than April’s forecast of 4.5 percent. While idiosyncratic factors such as high borrowing costs have prompted downward adjustments for some economies, these are offset by improving global demand prospects. The growth forecast for 2025 is broadly unchanged at 4.3 percent as regional economies converge to their trend growth.

Inflation for the 12 ASEAN+3 economies—excluding Lao PDR and Myanmar—has been revised down to 2.1 percent due to lower-than-expected food prices and imported inflation.

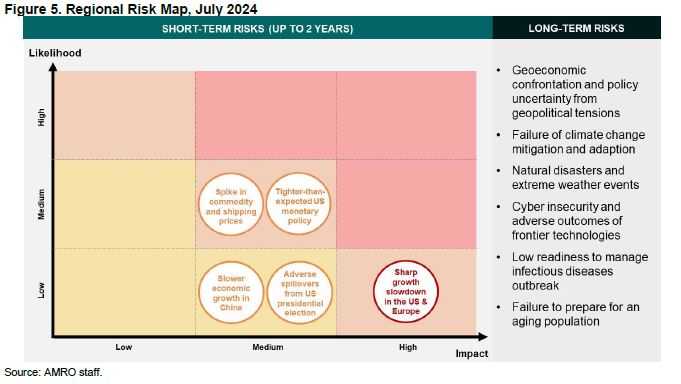

5. The overall balance of risks to the region’s outlook has improved since April. However, various risks could weigh on the baseline forecasts. U.S.-related risks have become more salient. Tighter-than-expected U.S. monetary policy could exacerbate capital outflows and weigh on many of the region’s currencies. ASEAN+3 asset markets could see higher volatility in the run-up to the U.S. presidential election. Spikes in commodity and shipping prices remain a concern, with La Niña-induced food price volatility and ongoing geopolitical conflicts potentially exacerbating those costs. Economic slowdowns in China, the U.S., or Europe could negatively impact the region through reduced trade, investment, and tourism flows.

Explore more charts and data at our Regional Economy Dashboard.