This article was first published as an op-ed in The Scoop on May 12, 2023

Brunei Darussalam has benefited from an abundance of hydrocarbon resources, which has contributed to the nation’s wealth and economic prosperity. The dependence on the oil and gas (O&G) sector also means that the economy is susceptible to global energy price shocks.

In 2020, Brunei experienced a large fiscal deficit due to a sharp drop in global oil prices when COVID-19 ravaged the world. However, thanks to a surge in oil prices last year, Brunei’s fiscal position has been improving. This shows that proceeds from the O&G sector tend to dominate Brunei’s fiscal revenue and its fiscal balance.

Aside from oil prices, Brunei’s fiscal revenue is also affected by production shocks, reflecting supply disruptions such as unscheduled maintenance of offshore O&G fields. What is the medium-term fiscal outlook given these potential shocks? How can the authorities strengthen fiscal sustainability?

Procyclicality of fiscal revenue with global oil prices

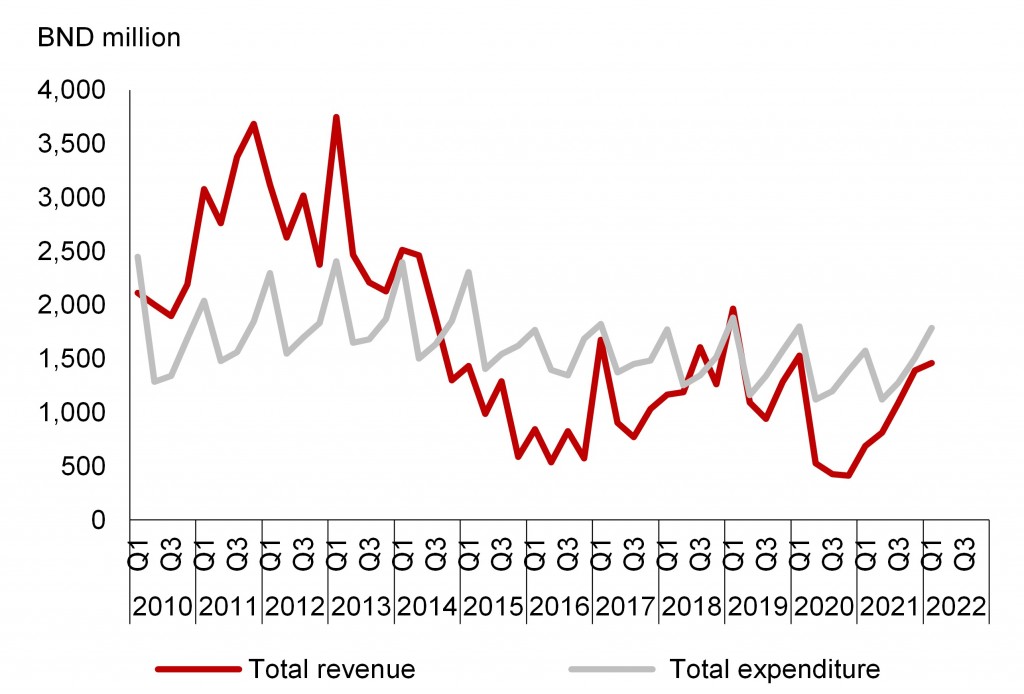

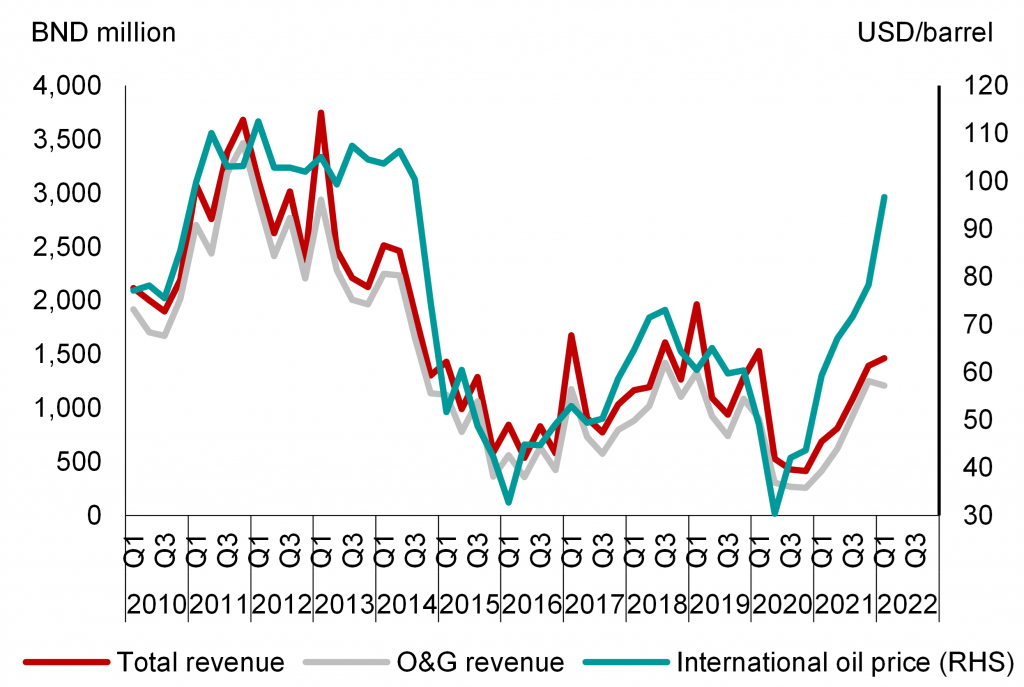

Shocks to energy prices, as well as production, could pose downside risks to fiscal sustainability. Over the past decade, Brunei’s fiscal revenue has fluctuated from BND500 to BND4,000 million per quarter. Meanwhile, fiscal expenditure has been largely stable at around BND1,500 to BND2,000 million per quarter (Figure 1). Developments in the last decade showed that fluctuation in fiscal revenue, in which the major component was O&G revenue (which varied from 58 percent to 94 percent of fiscal revenue), can be mainly attributed to oil price developments (Figure 2). Disruptions to O&G production also played a role in adding to the volatility in O&G revenue receipts.

Figure 1. Fiscal Expenditure and Revenue

Source: DEPS

Figure 2. O&G Revenue and Oil Prices

Source: DEPS; Haver

Note: RHS = right-hand side

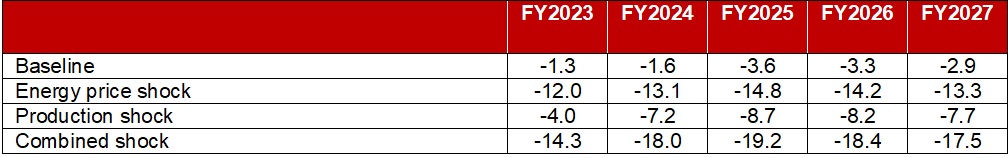

To gauge the medium-term fiscal outlook, the ASEAN+3 Macroeconomic Research Office conducted a fiscal stress test and designed three adverse scenarios against the baseline narrative: (i) an energy price shock, which assumes oil and LNG prices are one standard deviation below their baselines from FY2023–FY2027; (ii) an energy production shock, as the growth rates of the oil and gas productions are one standard deviation below their baselines in FY2023–FY2027; and (iii) a combined shock where scenarios (i) and (ii) take place simultaneously.

The stress-test results suggest that energy price/ production shocks could cause a significant increase in the fiscal deficit. Table 1 presents the fiscal balance under various scenarios. In general, the impact of an energy price shock on the fiscal deficit — on average 11 percentage points above the baseline — is more severe than that of a production shock, averaging 5 percentage points above the baseline. For the combined shocks, the fiscal deficit could increase by 15 percentage points, on average, peaking at 19.2 percent of GDP (which is close to the situation in FY2020 when the fiscal deficit was about 20 percent of GDP).

This exercise shows that it is desirable to undertake greater revenue diversification to reduce the fiscal revenue dependence on global energy prices.

Table 1. Fiscal Balance (Percent of GDP) Under Various Scenarios

Source: AMRO staff calculations

Notes: The changes in fiscal revenues and nominal GDP growth rates under different scenarios are estimated using regressions (see Appendix). The fiscal expenditures use the same growth rate assumed in the baseline scenario, but the percentage of GDP changes due to changes in nominal GDP growth rates.

Looking ahead: Directions for fiscal reforms

Reforms to diversifying fiscal revenue are a multiyear effort and, if successful, promises more resilient public finances amid constant volatility in the O&G sector.

First, fiscal revenue diversification could be achieved by attracting foreign direct investments (FDIs) into priority sectors to strengthen economic diversification over the long term. In particular, the country should leverage its comparative advantages — the abundance of natural resources and rich biodiversity — to attract FDIs such as downstream non-O&G industries, eco-tourism, and aquaculture. This would contribute to a more diversified fiscal revenue base. There is room to further attract FDIs in other priority sectors, such as info-communications and technology (ICT) and services.

Second, a more strategic use of funding by the sovereign investment fund can enhance fiscal revenue diversification. Specifically, a strategic investment by the Strategic Development Capital Fund (SDCF) can promote economic diversification, which, in turn, helps to foster a virtuous cycle. This would result in a more diversified and sustained source of fiscal revenue for the government.

Third, the current taxation system should be enhanced. Although the authorities are cautious about imposing new types of taxes, the tax base, should be broadened in the longer term. For example, some indirect taxes, such as the general sales tax at a low tax rate, could be considered by the authorities. Moreover, the authorities could raise fiscal revenues by improving revenue-collecting efficiency, such as digitalizing the tax-collection system.

Finally, the investment returns of the sovereign investment fund could be another revenue source. In Singapore and Hong Kong, for instance, the governments receive investment returns from the GIC and Exchange Fund respectively every year that form part of the fiscal revenue in the annual budget. Similarly, Brunei could consider including the investment returns of its sovereign investment funds in its fiscal revenues.